Soybeans, soymeal, soyoil, corn and wheat traded higher.US stocks traded marginally lower. US Dollar was lower. Crude as higher. Gold was higher.

SOYBEANS

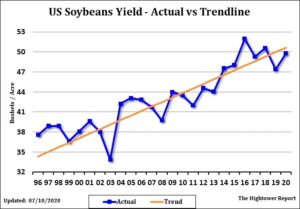

Soybean traded higher on concern about lower US 2020 soybean crop. There is concern that dryness across the Midwest and strong winds last week may have taken the top off the USDA record crop estimate. Trade expects USDA to drop the weekly US crop rating to 72 pct good/ex versus 74 last week. Pro farmer tour is this week. Today, in both SD and OH tour participants found more pods in fields than last year. The tour will report results from today tonight and travel through NE and IN tomorrow. Weekly US soybean exports were near 28 mil bu versus 42 last year. Season to date exports are near 1,504 versus 1,597 last year. USDA goal is 1,650 versus 1,752 last year. USDA estimates 2020/21 US soybean exports near 2,125. Nov soybean futures have traded over the 200 day moving average for the first time since Jan. Resistance is near 9.20. Farmers should increase 2020 cash sales.

CORN

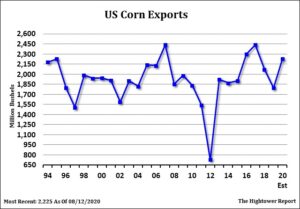

Corn futures traded higher and closed near session highs. Uncertainty over the size of the US 2020 corn crop triggered fund short covering. Combination of dry weather across the Midwest and last week’s strong winds may have taken the top off the US record corn yield. Pro Farmer Annual tour is the week. Participants in SD estimated the corn yield near 184.6 versus the trip average last year near 152.8. USDA August guess was 167.0. OH tour yield was 170 versus USDA August guess of 175. Tour will announce todays numbers in a report tonight. Tour will be in NE and IN tomorrow. Trade expected USDA to drop Weekly US corn crop rating to 68 pct good/ex versus 71 last week. There are a range of ides of US corn losses due to heavy winds from 300-1,200 mil bu. Weekly US corn exports were near 41 mil bu versus 20 last year. Season to date exports are near 1,587 versus 1,817 last year. USDA goal is 1,795 versus 2,066 last year. USDA estimates 2020/21 US corn exports near 2,225. Sep corn futures is near 100 day moving average. Resistance is near 3.40. Farmers should increase 2020 cash sales above 3.50 CZ.

WHEAT

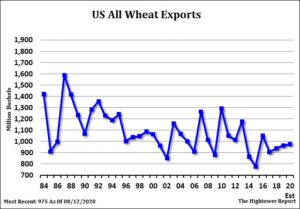

Wheat futures traded higher. USDA announcement of new US HRW export sales to the unknown raised speculation that it could be China. Some though feel they sale was to Africa. There was talk last week that China was a buyer of French wheat. This rallied French wheat futures last week. Some dryness in Argentina and Canada may have also supported prices. Weekly US wheat exports were near 17 mil bu versus 24 last year. Season to date exports are near 206 versus 202 last year. USDA goal is 975 versus 965 last year. Farmers should increase 2021 cash sales. Most US end users remain hand to mouth buyers on uncertainty over future demand due to Covid. WZ resistance is near 5.40. Support is 5.00. Open interest in going up on increase volume. KWZ resistance is near 4.60. Support is 4.20. Open interest in going down on increase volume. MWZ resistance is near 5.30. Support is 5.05. Open interest in going up on increase volume. Trade estimates US spring wheat harvest near 30 pct. Crop is rated 68 pct good/ex.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.