London Wheat Report

Happy Monday All!

Well, what a weekend on the old rugger. Portugal had an absolute corker with their first world cup win and thoroughly deserved. Scotland had it handed to them. England sneezed into the quarters, going to be tough going against the Fijians. Farrell’s go-slow kick just once again solidates the answer to keep him out the squad for the next game but I doubt this will happen – Borthwick seems to just not see it and has blind loyalty to Farrell but down a slippery slope we could go on with this …

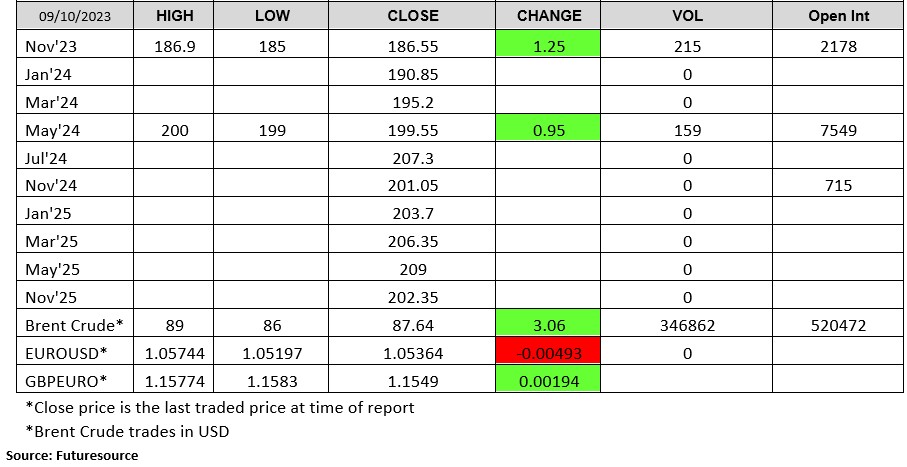

Well, unexpected turn of events over in Israel on Saturday morning as Hamas kicked off one of their most substantial attacks for decades on the Gaza border. Over 4,000 missiles fired, border wall rammed at multiple crossings, couple of amphibious landing attempts and over 700 people have lost their lives in Israel. Horrific scenes seen on both sides and it is always the average person who loses out. Israeli ground invasion anticipated within the next 48hrs. Going to be brutal. Energy kicked up with Dutch Gas TTF’s trading up 13% this morning, Brent was up 3.8% at time of writing at $87.80/ba with questions pointing towards Iran’s crude exports.

Wheat markets were supported today as money moved to safer havens with the ag complex being one of those. Eyes remain on the Black Sea as ships are loading up with corn destined for China through the humanitarian corridor. Russia’s IKAR raised Russian grain production estimate to 141.2Mmt from 140Mmt previously due to stronger corn harvest. This is above the Russian Ministry of Ag’s predictions of 135Mmt – still colossal volumes which will keep Russian export terminals sucking diesel. Chicago wheat was trading with Dec-23 up 4 cents at time of writing and Matif Dec-23 was trading up €2.75 going into the close at around the €237.50 level. London wheat was pretty flat by all accounts.

Trades estimates coming in before the report later this eve that US corn harvest is circa 35-38% complete and soybeans are close to 50%.

Oilseeds were mixed with Chicago soybeans trading lower. Brazil’s soybean planting at fast pace even with weather issues according to AgRural with 10.1% complete as of Thursday last week. Russian oilseed production – inclusive of sunflower, soybean and rapeseed to a record 16.98Mmt according to Rusagrotrans. Matif rapeseed was marginally supported, with Nov-23 trading around €427/€428 levels into the close.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.