ADMISI London Wheat Report for 9 January

- January 10, 2024

- ADMISI Grains Team

- Follow us on Twitter @ADMISI_Ltd

London Wheat Report

A landmark legal case about whether Donald Trump should be immune from criminal prosecution has been heard in Washington, no decisions have yet been made. Ex-Post Office boss Paula Vennells says she’ll hand back her CBE “with immediate effect”. North Korea’s Kim Jong Un has hit the big 4-0 – or at least, that is what people suspect.

Corn and Soybeans have had a torrid time of late and prices have been at multi year lows for both contracts. Sliding oil prices and favourable weather meant bullish news in these markets was few and far between. Corn today had a bounce, as did Soybeans all be it after sliding down another 10 cents in the early part of the main session. Corn was trading up 4 cents at the time of writing, beans just above level, which considering the start they had wasn’t bad going.

Paraná (state), which will likely be Brazil’s third largest soybean producer in the 2023/2024 season, is facing the prospect of lower yields amid dry and hot weather in key areas, some of which are already being harvested. According to state crop agency Deral on Tuesday, its newest soy crop evaluation shows 71% of fields in “good” condition compared with 86% last week. If rains don’t come soon enough, total state output could come in below a forecast 21.7 million metric tons, Deral said.

Soft wheat exports from the European Union since the start of the 2023/24 season in July had reached 15.84 million metric tons by Jan. 7, down 11% from a year earlier, data published by the European Commission showed on Tuesday. EU barley exports totalled 3.17 million tons, up 3% from the corresponding period in 2022/23, while EU maize imports were at 9.03 million tons, down 43% from a year earlier.

US wheat markets gave back what was taken from them yesterday. Chicago and Kansas were double digit up and Minap wheat was 8 cents to the good.

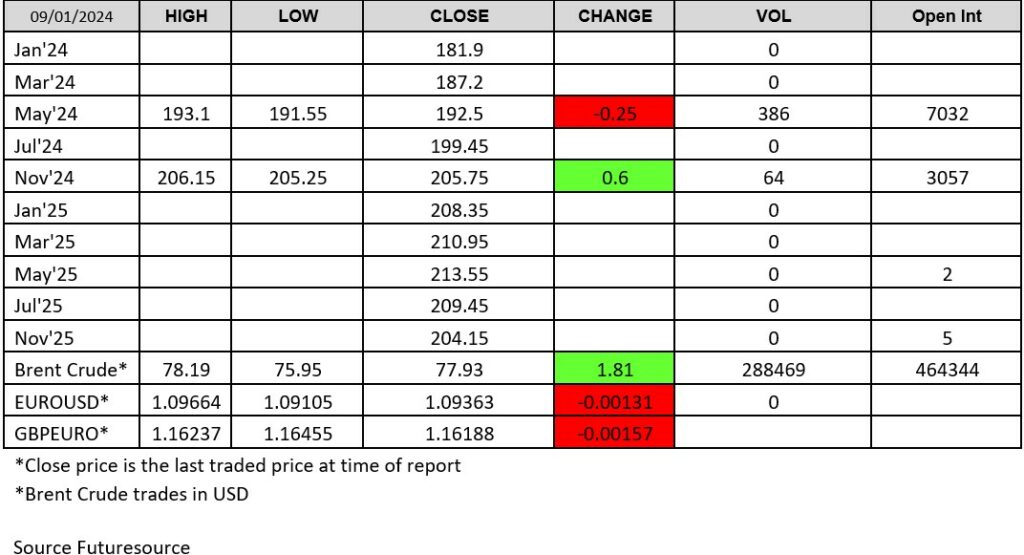

Matif and London Wheat found support today to end positively. Matif had traded positively all day but that wasn’t the case for London. Until lunchtime, London may had traded down before turning the corner. The May/Nov spread still stands at around £13. Volume was a little less than yesterday but was still pretty solid, over 400 lots crossing the line across the curve.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.