London Wheat Report

Source: FutureSource

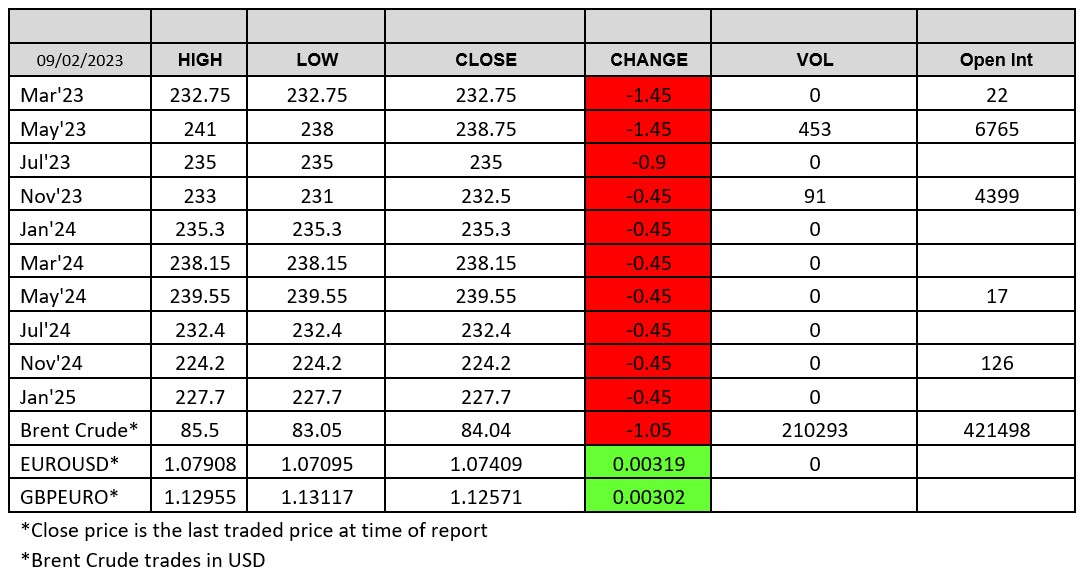

Well, regretfully the death toll continues to rise in the Turkish/Syrian earthquake reaching over 17k casualties now. Zelensky is doing the rounds of EU countries to try and obtain additional support. London scored a triumph of being the second destination for the President to visit overseas after Washington and the French were left slightly embarrassed … shame. Pretty uneventful WASDE report yesterday, nothing to spice up February. USD is lower today. Brent Crude is also trading marginally lower.

Chicago wheat was off today after seeing a little bounce yesterday post WASDE due to a stronger domestic balance sheet. US weekly wheat sales slipped 4% to 131,400t, exports did advance by 9% which was a positive sign. Rouen’s weekly wheat exports drop to 39.7kt, led by West Africa. Russian wheat still remains cheap, cheap, cheap, and will be into the foreseeable future. There was definitely additional capacity to add in more for the Oz and Russian production numbers as the USDA are still behind on these. More rumbling about grains corridor, this is a little bit of a long shot overall unless the rumoured upcoming offensive turns nasty although, as we have said previously, there is no benefit for the Kremlin to play silly games. Algeria are tendering this week, tender was meant to have closed but apparently they have reopened this.

Matif was trading lower today with trading volumes back down to average figures. EU soft-wheat production in the 2023-24 season is now seen at 129.7m tons, up from a January estimate for 129.3m tons, analysis firm Strategie Grains said in a report. London wheat was trading lower with volumes very unexciting. UK wheat production figure was left at 15.5Mmt and exports at 1.3Mmt. Proposed merger between For Farmers and 2Agriculture has been pulled mutually by both parties, prior to the CMA launching an in depth investigation. Unsurprising as they would have cornered the feed market in the North West among other places.

Chicago soybeans were trading pretty unchanged today. US weekly sales down 38% W-O-W but within expectations. Massive crop in Brazil really does appear to be putting resistance onto the market. Matif rapeseed dropped lower.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.