London Wheat Report

Source: FutureSource

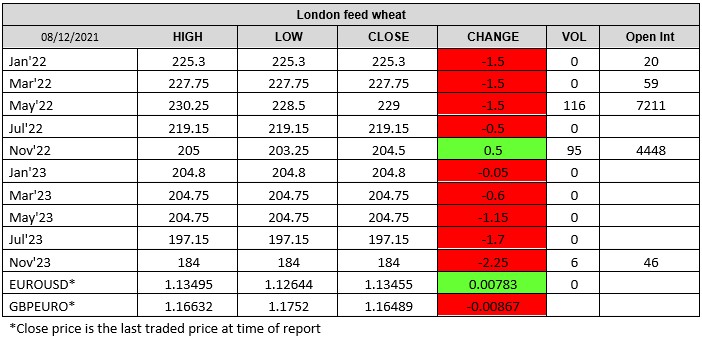

Wheat markets remained rather subdued in today’s trading, both in the US and Europe, unsurprising and quite normal prior to a USDA report day. Trade is waiting for an update on Australia’s harvest, with hopes that a drier spell in the coming week will avert further quality damage. FranceAgriMer lowered its forecast of French soft wheat exports outside of the EU for a second month in a row – cutting the 2021/22 season down to 9.2Mmt from 9.4Mmt estimated in November. It has also increased French soft wheat ending stocks by the end of the 2021/22 season in June next year to 3.5Mmt, up from 3.2Mm estimated last month. On the international front, Australia and the UK have joined the diplomatic boycott of the Beijing Winter Olympics, very frosty indeed. Russian wheat values continue to climb, will we hit the $90/t export tax next year? Reports appearing on Refinitive of favourable weather conditions in Russia with 2022/23 wheat production projected at 87.3Mmt. Still early days. Biden and Putin’s chat didn’t obtain anything concrete, talks are supposedly set to continue. Actual invasion theory seems unlikely by many but Ukraine are worried about a potential internal strife. Remember those little green men in Crimea in 2014? Trade doesn’t see any major threat of grain boats being taken out by the Black Sea fleet. Will be interesting to see what materialises going forward. Matif Mar-22 settled down €4.75 on yesterday at €287, settling down 10 of the last 12 sessions.

Mexico has come in hot on the US corn scene. 1,089,660t booked for this year and 754,380 for next. US biofuel mandates have been proposed by the US Environmental Protection Agency (EPA) for 2020 (at 17.13B gallons), 2021 (18.52B gallons) and 2022 (20.77B gallons). Retroactive mandates for 2020 and 2021 are below 2019 levels. But 2022 is a proposed increase from 2019. (AHDB). According to Refinitiv, the EPA have also kicked 65 smaller refiners to the curb and another $700-$800m in aid earmarked to biofuel producers impacted from Covid and demand destruction. No doubt lawsuits will fire up soon on both sides and this will remain a key topic for the foreseeable. Matif Mar-22 corn settled €2.75 lower on yesterday at €242.50/t. Will corn prices pull down the extent of UK Feed wheat gains moving forward?

China has dabbled again in soybeans, booking 130kt on daily reporting. Malaysian palm oil futures are lower, pulling back from the rebound in values earlier in the week. Brazilian dryness is a key area of focus in the coming weeks. Matif May-22 rapeseed turned bullish, gaining €5.75 on last night to settle at €663.50/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston, Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025