London Wheat Report

Source: FutureSource

Markets await tomorrow’s WASDE report. CBOT soybean and corn futures drifted lower in today’s trading as positions are adjusted before the release of the key WASDE figures tomorrow (17.00 London time). Big US harvests and near perfect weather for panting in Brazil (67% complete as of Nov 4th) and signs of slowing purchases by top buyer China are guiding soybeans and corn, two of the top globally traded commodities. In October, China purchased 81% of Brazil’s monthly soybean exports, equating to 2.7Mmt. China bean imports for October have also seen a steep decline, down 41% YOY at 5.1Mmt and down 26% from September volumes. The effects on crush margins and Gulf loading issues post Hurricane Ida combined with South American positive cropping have all had an effect. 150kt of corn has been bought by Colombia today and Turkey have tendered to purchase 325kt of corn for Dec delivery. Chicago Jan-22 soybeans were trading down 15 cents and March-22 corn was trading down a cent and a half at time of writing.

US wheat futures remained supported with market anticipation for the USDA to tighten global stocks. Market demand remains, as shown by the recent importer tender run. Matif wheat futures cooled due to lack of export demand and a cautious market mood. European traders are waiting in anticipation if Algeria will issue a tender for December shipment. Talk in France is that Ukrainian wheat was taking a large share of initial purchases by Moroccan buyers in the country’s import season that opened on Nov-1. German traders said export shipments were slowing in November after very large loadings earlier in the Autumn. 12% milling wheat for Nov-21 delivery was offered for sale at about €2.5/t below Matif Dec-21 futures. Matif Dec-21 settled down €4.00 on Friday’s close at €283.75/t and Mar-22 settled down €3.75/t at €279/t.

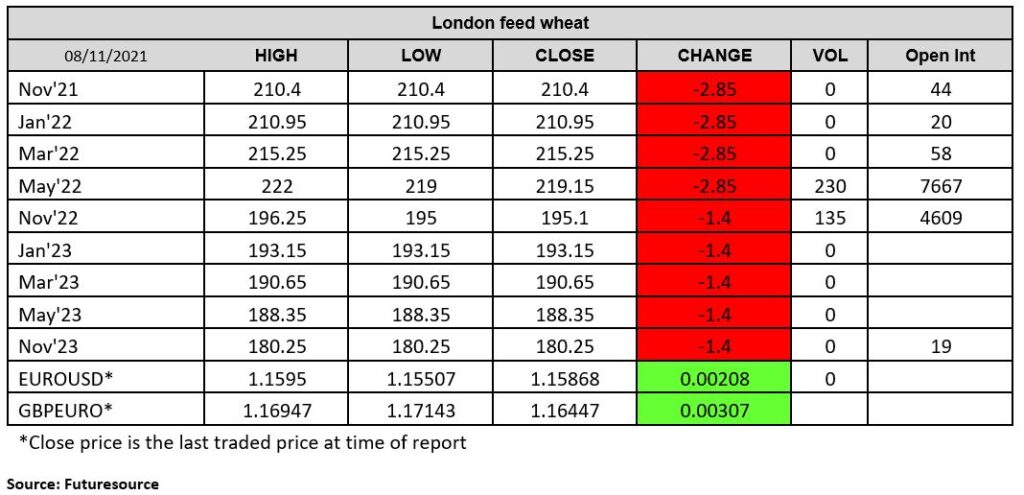

London wheat futures followed Paris lower in today’s trading. Prices are still strong and are reflective of current global trends and UK tightness. Feed barley is continuing to track feed wheat higher with Nov-21 delivered into East Anglia at £205/t (AHBD), £13.50/t below feed wheat. Fertiliser purchasing by UK arable farmers has remained strong. The demand destruction from less winter wheat/OSR that some were expecting has not materialized to a full extent with the Livestock/Grassland boys taking the bear of the brunt (ADM Agri).

Matif rapeseed fell back due to Soybeans turning bearish albeit prices still remaining strong with a bullish sentiment moving forward into the new year, especially for those who have the infrastructure for safe storage. May-22 delivered Erith is quoted at £601/t (AHDB). Sterling weakened (-1.39%) against the Euro last week, helping keep domestic prices strong. Matif Feb-22 rapeseed settled down on €6.50 on Friday at €678.50/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston, Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025