ADMISI London Wheat Report for 7 September

- September 8, 2022

- ADMISI Grains Team

- Follow us on Twitter @ADMISI_Ltd

London Wheat Report

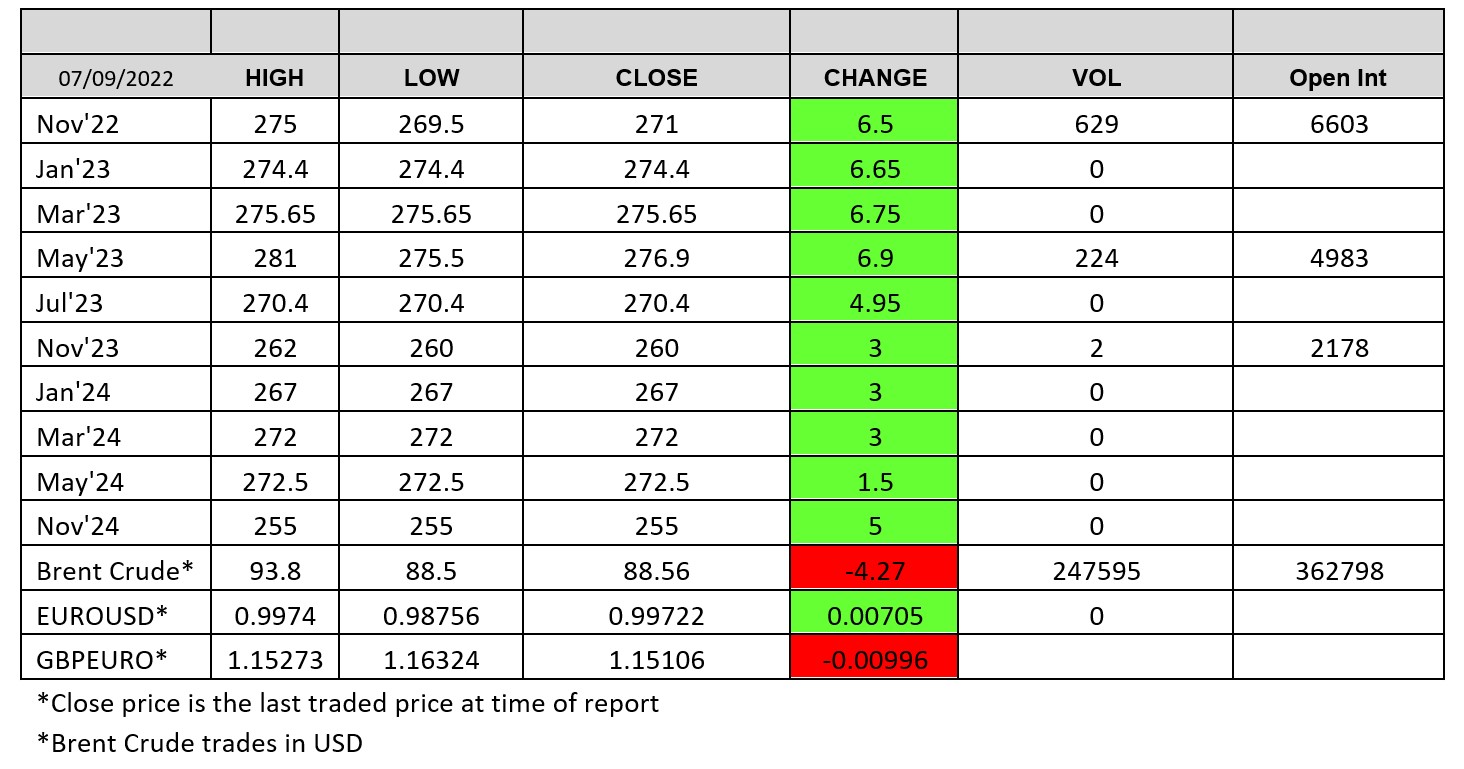

Source: FutureSource

The Vladimir Putin show kicked off Wednesday morning at the Russian economic forum in Vladivostok. Vlad isn’t happy with the current set up on the Ukrainian grain exports agreement and also said that all energy supplies to Europe would be halted to Europe if Brussels decides to cap the price of Russian gas. Putin said the accord was delivering grain, fertiliser and other food to the EU and Turkey rather than to poor countries who should be given priority. Vlad claimed that only 2 of the vessels have gone to ‘poor countries’ and the remainder to the wealthy nations. No surprises as we approach the rollover period for the grain deal that sabre rattling has fired up, especially as the Kremlin are starting to harden their stance on energy towards Europe, the Ace cards are starting to be played .. but how long can these be sustained. Hints are being pushed that an easing of sanctions will ensure that all contractual volumes of gas are honoured … tell-tale signs that the winter coffers will be shrinking or a hint towards a deal? Rosneft have supposedly signed terms to slam an oil pipe line through Mongolia to China. Gazprom is planning to sell gas to China in both rubles and yuan to shift away from the euro.

Wheat took off unsurprisingly in today’s trade. Chicago Dec-22 shot up on the main open, hitting a high of 56.5C above last night’s settlement as managed money shot in to the playground. Interestingly, primary exports out of Ukrainian ports this far have been corn. Russian wheat is still the cheapest on the market and export vols are taking a while to fire up. Would it make sense for them to block the Ukrainian deal and risk hampering their own exports? Chicago Dec-22 had pulled back at time of writing and was trading 25c up on yesterday. Matif Dec-22 wheat also shot up on the news, hitting trading highs of €333/t before settling up €10 on yesterday at €328.75/t. Jordan bought 60kt of wheat, likely Russian origin. Rumours that GASC had purchased more Russian wheat yesterday as it appears to have left the public tender method for now.

USDA corn and soybean conditions remained steady while spring wheat harvest progressed at a faster than projected clip in the week to Sept 4th. Refinitiv have left EU-27 corn production at 60.3Mmt due to improved rainfall and better 2 week forecast upcoming. South Korea booked a cargo of 135kt of corn. Mexico purchased 257,400t of new crop corn according to the USDA. Chicago corn was trading marginally down post crop update.

Argentina farmer sales of soybeans dropped 52% in the last week of August. Brazil’s soybean exports to hit 3.9Mmt in September according to ANEC. China’s soybean imports fell 24.5% in August from a year earlier, customs data showed on Wednesday, as high global prices and weak demand curbed appetite for the oilseed. Matif rapeseed Nov-22 settled up €3.75 on yesterday at €609.25/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.