London Wheat Report

Saudi Arabia has purchased 307,000 metric tons of wheat in a tender for arrival between December and January, the GFSA state buying agency said on Monday. The tender sought hard wheat with 12.5% protein, with the purchase was slightly above the 295,000 tons sought.

Chicago corn and soybeans fell on Monday as a stronger dollar and expectations of good harvest weather as well as record inventories in the U.S. provided headwinds to prices. The latest CFTC commitment of traders’ report showed strong buying to the 1st October, for the 7th consecutive week. Money managers bought back 216,000 contracts- the highest weekly amount in 5 months and flipped their position to net long for the first time in just over 1 year! Shorts remain In corn, wheat & beans, but we see longs in livestock and soybean products.

Russia’s grain harvest will be hit by the impact of Ukraine’s attacks on grain-producing regions close to the border and by bad weather in many other regions, the RIA news agency cited Agriculture Minister Oksana Lut as saying on Monday. This comes a day after a Russian missile strike damaged a civilian Saint Kitts and Nevis-flagged vessel loaded with corn in Ukrainian port of Pivdennyi on 6th October, the Ukrainian restoration ministry said on Monday.

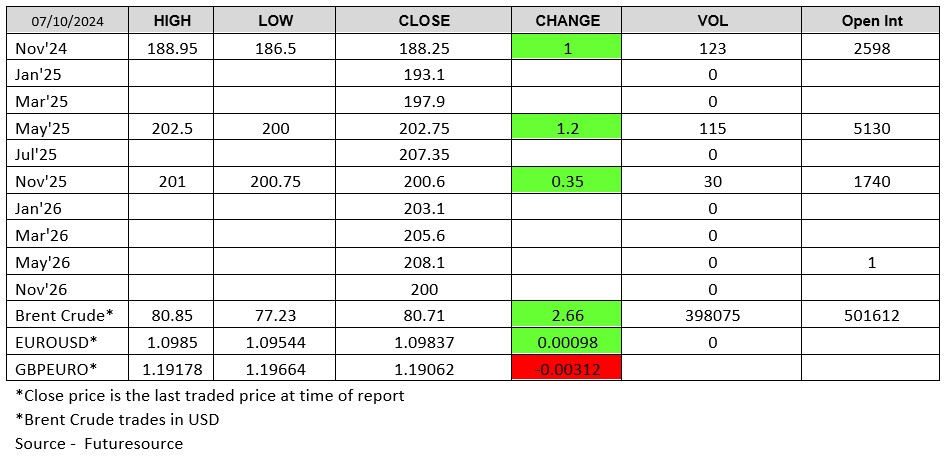

European wheat was supported in today’s trading after a brief spell in the red in the morning. London volume was lethargic to start the week with just over 200 lots making it across the line.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook, Aaron Stockley-Isted and Jamie Kirkwood

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025