London Wheat Report

Source: FutureSource

Fighting talks are on the up in Eastern Ukraine as Ukraine reports one of the deadliest days so far. Reports that the Kremlin is pouring thousands of troops in the Donbass with all the rumour mills pointing towards a renewed and intensified campaign in the next few weeks. Public transport, schools and refinery supplies in France were disrupted on Tuesday as trade unions led a third wave of nationwide strikes against President Emmanuel Macron’s plans to make the French work longer before retirement.

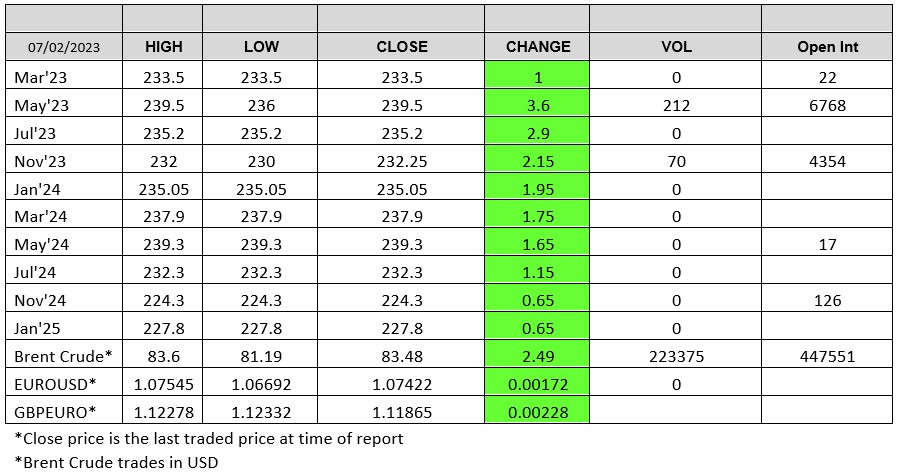

Wheat markets were more buoyant today in comparison to yesterday. KC wheat was up on both Chicago and MWE. USDA WASDE report is due to go live tomorrow. Stats Can’s latest numbers were pretty bearish towards wheat with all wheat excluding durum up over 4.3Mmt – nothing unsurprising here and all within market expectations. Matif wheat has further support today, following on the back of the rumours of UK wheat sales across to the US with a Panamax out of Immingham apparently. Matif wheat May-23 settled up €4.50 on yesterday at €290.50/t with some great volumes traded on Matif. Mar-23 saw 48,928 lots traded and May-23 saw 29,137 lots traded. London wheat saw additional support on the back of the UK wheat sale and also the support from Matif.

Brazil 2022/23 Soy Harvest 9% Done as of Feb. 2: AgRural This compares with 5% a week earlier and 16% a year ago, consulting firm AgRural said in an emailed report. EU weekly soybean imports rose to 267kt in the week to Feb 5th. Brent crude was up 2.8% at $83.29/ba and Matif rapeseed May-22 settled at €553.50/t, up €3.25 on yesterday.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025