London Wheat Report

Source: FutureSource

US ag markets continued to cool with a defensive tone in corn, beans and the winter wheat markets. The trade is looking forward to the potential of higher production and higher ending stocks on Tuesday’s report. Corn and bean outlook hasn’t changed much from yesterday, domestic demand remains quite good while export interest is so so. Yesterday, the primary news was Brazil offering late December beans with China keen on the tail of these, potentially handicapping long term demand from the US. It is becoming apparent now that the US is losing export potential to South America. Brazil are currently steaming ahead with planting and no production pressure points are on the horizon with a good forecast for the near term. Corn and soybean shipping, although behind on last year has firmed over the past week while the supportive energy component has cooled. US ethanol production is pushing forward with no signs of slowing down, buoyed by strong brent prices. Chicago Jan-22 soybeans were trading down 14 cents and Dec-21 corn was down 5 cents at time of writing.

Global wheat markets pulled back as corn and soybeans continue to be bearish. Prices are still strong and a correction is due, but like all anticipated corrections, when this will happen is up for debate. Pakistan did not make a purchase on the 90kt tender that closed today, with offers coming in between $407-$412 c&f, $30/t above the price paid for the 550kt in October and $13/t above levels that Pakistan rejected last week. Much debate is expected on the USDA 72.5Mmt Russian crop as final figures appear to be coming to a close. Rains in Argentina have boosted what development and maize sowings, according to the Buenos Aires Grains Exchange. Matif Dec-21 settled down €2.25 on yesterday at €287.75/t and Mar-22 settled down €3.00 on yesterday at €282.75/t.

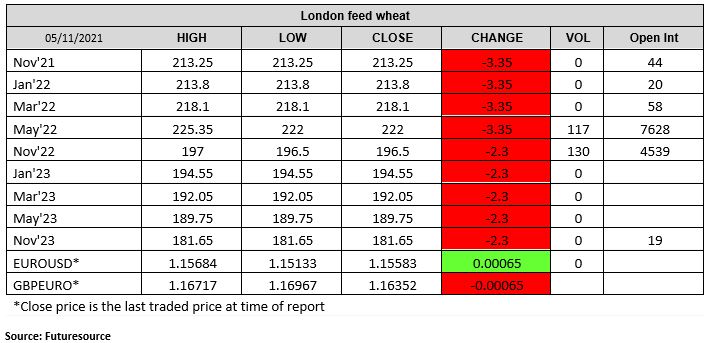

London wheat cooled further with May-22 settling down £3.35 on yesterday at £222/t and Nov-22 settling down £2.30 on yesterday at £196.50/t. Final quality results from harvest 2021 have been released by the AHDB. Average specific weight of UK flour millers Group 1 varieties remain at 75.4kg/hl, the lowest since 2012 (70.7kg/hl). Hagberg Falling Number remained at 286 seconds. This is 36s below 2020 results and 33s below the 3 year average. Lowest since 2017.

Have a great weekend all!

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston, Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025