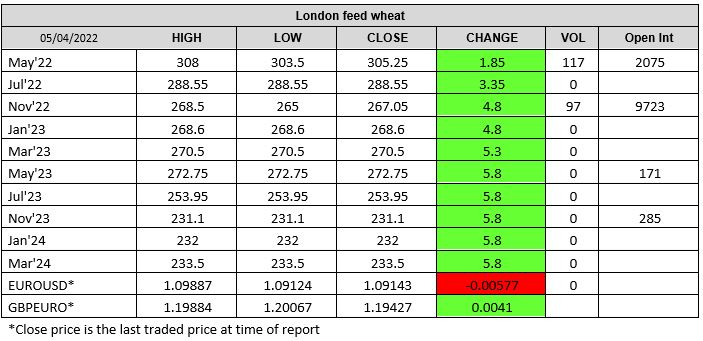

London Wheat Report

Source: FutureSource

Wheat markets fired up following on from yesterday’s USDA crop progress report. USDA rated US winter wheat as 30% good/excellent in the first nation condition report of the season. Trade was for an average rating of 40% with estimates ranging from 32% to 47% gd/ex rating after rains have fallen over southern plains in the past several weeks. This was 2nd lowest crop ratings on record. KS ratings were unchanged at 32% gd/ex. OK improved 4% to 22% gd/ex from last week’s state estimate. TX was unchanged at 7% gd, no excellent. This allowed Chicago wheat to steam forward with May-22 trading up 29 cents at time of writing.

Wheat tenders were back in force. Following on from the Saudi tender yesterday, Bangladesh purchased 50kt of Indian wheat and Jordan has re-entered their tender for 120kt milling wheat. Iraq bought 100kt of alleged German origin milling wheat and Lebanon has secured a loan from the World Bank of $150m to secure 6 months of wheat. Chatter about Russians bombing infrastructure in Odessa continues. More chatter about the risk of floating mines in the major Black Sea shipping lanes that have come loose or weren’t secured properly in a true Soviet ‘slam em in’ style. Both sides accuse each other of laying mines. London marine insurance brokers have already put Black Sea and Azov on the high risk area. Matif May-22 settled up €0.75 on yesterday at €364.50/t.

More sanctions are appearing on the horizon to ban Russian coal and oil exports from the EU which includes stopping Russian ships from entering ports. Assault on eastern and southern Ukraine continues.

Leaders from Argentina’s major transportation union announced yesterday that they intend to call for a national strike to demand an increase in grain freight rates as higher fuel costs cause tensions

throughout the industry. With 86% of soyabean transportation to ports by truck, and the bulk of the soyabean harvest in the second quarter of the year, strike action could come moving into a key period. Added in to the transport issues surrounding the continued low levels of the Parana river and ship having to double load. Soybeans are seeing support on the back of increased wheat levels today alongside better demand on the back of a reduced Brazilian crop. Matif rapeseed May-22 settled up €15.50 on yesterday at €959.75/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025