London Wheat Report

Source: FutureSource

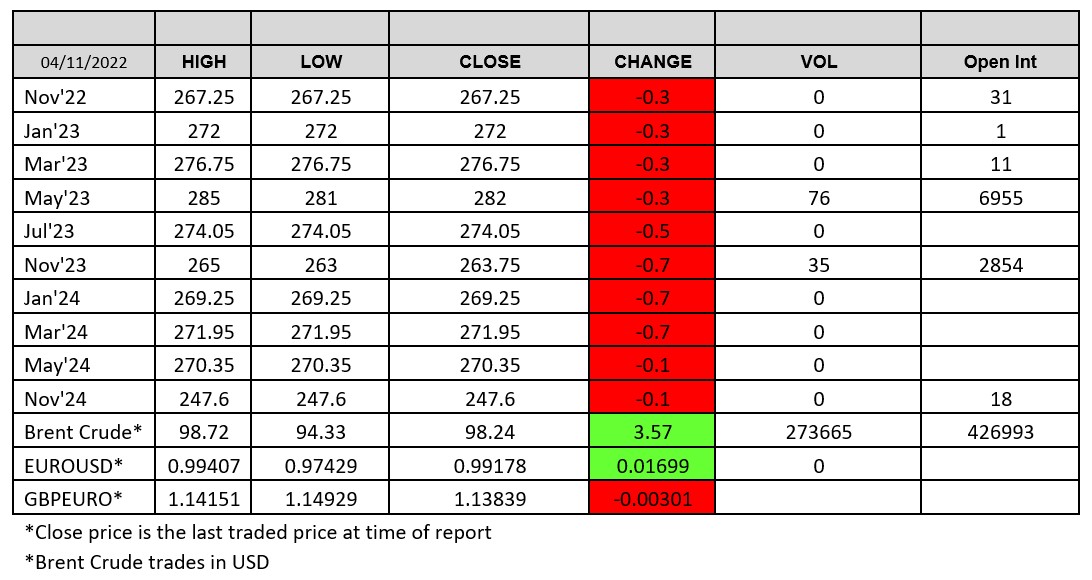

TGIF. Well what a whirlwind of week we’ve had, substantial excitement and maybe a little too much for some. Chatter continues that Xi and the gang are going to see sense and relax existing COVID policy but none of this appears to be mentioned in the official channels that are coming out of China. Weak USD and a rally in crude helped pull up Chicago markets. Brent crude has shot up to $98.72/ba at time of writing, last trading up 4% on yesterday, major gains. Was reassuring to see how substantial the oil majors profits were for Q3 this week. Poor Saudi Aramco. Volatility can be expected to continue as the trade analyses the Mid-Terms and CPI data alongside the WASDE is expected next week. Not much change is anticipated. Black Sea woes and China won’t be disappearing any time soon. Chicago wheat pushed higher on technical selling and end of week short covering, who knows what may appear. Weaker USD and concerns about available supplies are also supportive. Russian commitment to the grains deal is still very much smoke and mirrors. Trade community and UN appear to assume that it will continue but nothing of the such has come out of the Kremlin. Erdogan and Putin stated after their meeting yesterday that Russia would be accommodating to supply free grain to the poorest nations. Wonder what the catch 22’s of this are going to be …. Iraq bought 150kt of wheat sourced from Lithuania and Australia. Matif Dec-22 settled down €1.50 on yesterday at €339.25/t. French wheat and winter barley crop development was running about a week ahead of the five-year average by Oct. 31, farm office FranceAgriMer said today. Soft wheat in France, the European Union’s biggest grain producer, had emerged from the ground on about 61% of the expected area by Oct. 31, compared with 42% last year and six days ahead of the five-year average. sown 84% of the expected soft wheat area for next year’s harvest by Oct. 31, compared with 63% a week earlier. US railway union strike possible as early as November 19th as the transport unions get confident, turning down the 24% pay deal earlier on. I smell greed and insanity. Time to make an example of them. Can’t Biden doing much though, as usual. Soybeans have continued to find support, especially from crude and energy markets. Additional support is also anticipated from hopes of improved export demand. Palm oil’s large discount to soybean oil may shrink as prices of competing vegetable oils may ease in the first half of 2023, according to Thomas Mielke, executive director of Hamburg-based Oil World. Matif rapeseed Feb-23 settled up €4.75 on yesterday at €664.75/t. |

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.