ADMISI London Wheat Report for 31 July

- August 1, 2023

- ADMISI Grains Team

- Follow us on Twitter @ADMISI_Ltd

London Wheat Report

Source: FutureSource

Happy Monday All!

Well, the coup in Niger bumbles on. European heatwave continues although widespread rains in Germany are really hampering harvest progress according to our German friends. Sunak has confirmed over 100 new exploration licenses for the North Sea in both oil and gas alongside carbon capture. Wall Street was supported in this morning’s trade.

Well a sea of red across the wheat markets today as markets fall lower. Lack of weekend pyro from Moscow and positive precip forecasts in US, meant that there was minimal for the bulls to chew on. Black Sea murmurings continue with the Kremlin saying this morning they are very much keen to get the corridor up and running again as long as their demands are met ….. same old chatter but it did add to bearish sentiment. US weekly wheat inspections were up 61% to 581,278t W/E 27th July with the top destination being China! Tunisia were in for a 117kt milling wheat tender. Algeria have also joined for a nominal 50kt optional origin wheat tender for October shipment which will inevitably equate to far more.

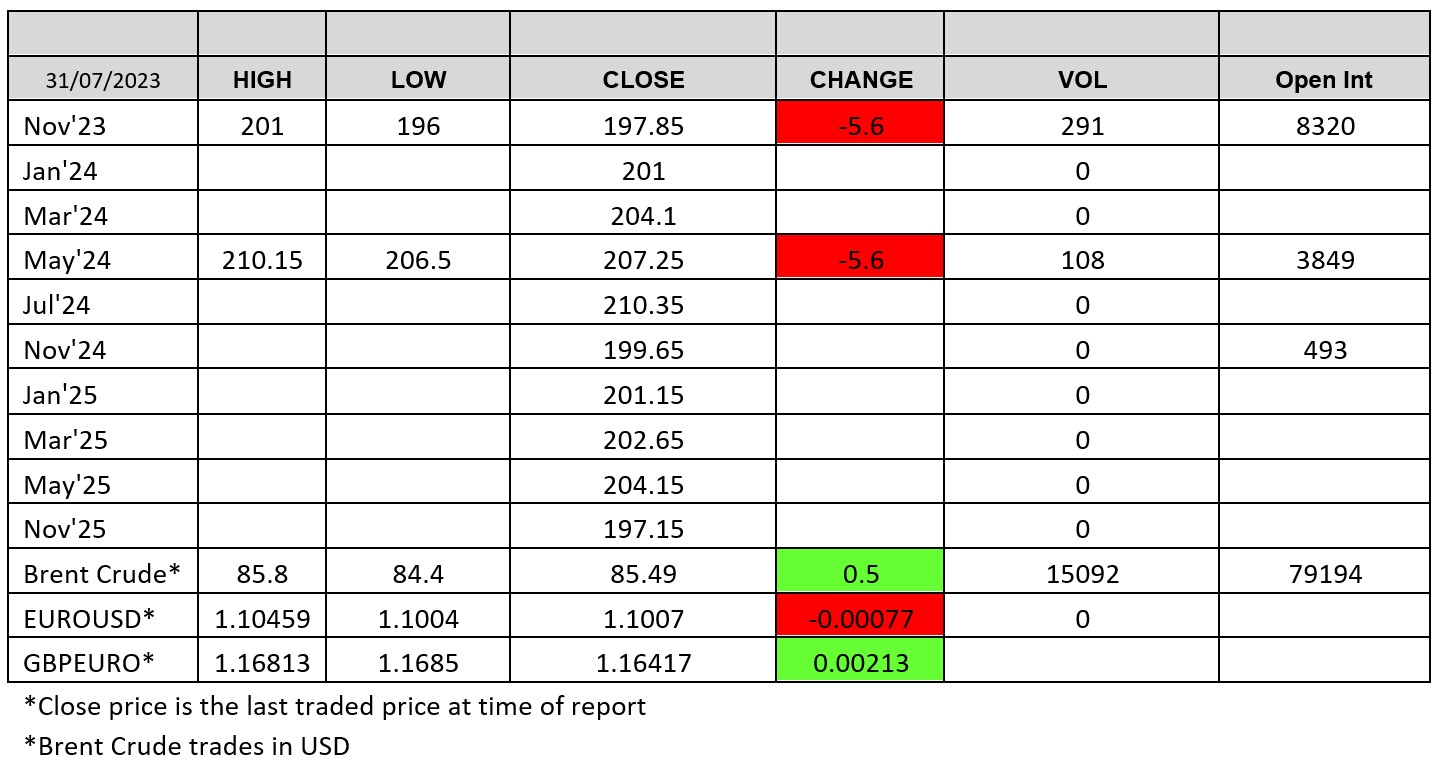

Norther European harvest continues to be patchy, very much like the weather. German harvest is circa 30% complete now with incentives from companies such as BayWa being reported offering free drying up to 16% on milling wheat in certain German states including Saxony. France is sat around 80% harvested while UK wheat crop is circa 5% with rains hampering play. Chicago was pulling much lower on Friday’s close, with Sep-23 trading through the 670 levels, trading down 41 cents at time of writing at 663 level. Matif also very much came off with Sep-23 wheat settling down €7.75 on Friday’s close at €240/t. Trading vols weren’t bad. London wheat also pushed lower, Nov-23 trading through the £200/t level this morning and pushing down to a trading low of £196/t.

USDA reported further bean sales to with 183kt of meal to the Philippines and 132kt of beans to China. Trade is looking at this evening’s crop ratings from the USDA for corn and soybeans to be down by up to 3% but this isn’t really having much effect on the market due to favourable forecasts and temps not being prevalent across the central belt. CFTC today showed managed money covering net short in Chicago corn. Brazil’s corn harvest is reported to be 55 complete with ‘excellent’ yields reported according to Agrural. US weekly corn and soybean inspections showed gains. Matif rapeseed pulled back again with Nov-23 rapeseed settling down €13.75 on Friday at €445/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.