London Wheat Report

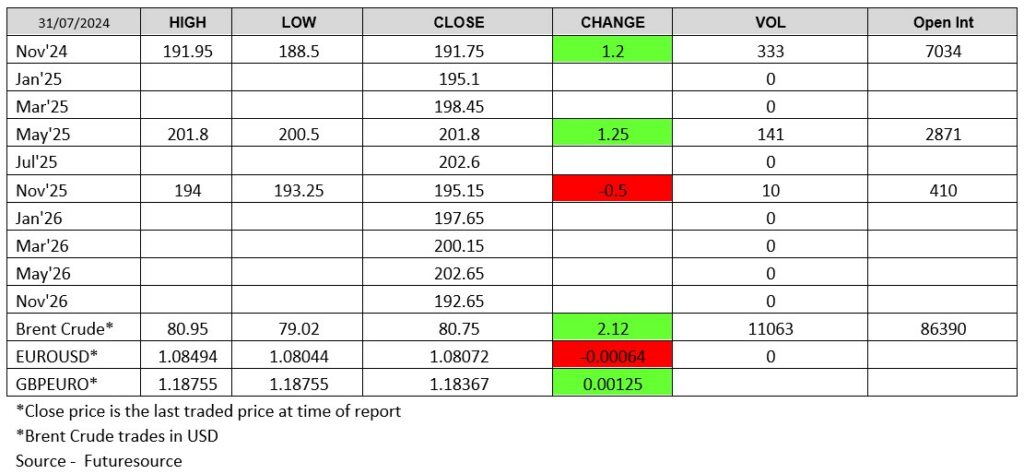

A similar start with trade generally lower in the overnight before a rebound led by wheat.

Some analysts stating that Australia, the world’s fourth-largest wheat exporter, is on course for an improvement for its 2024/25 wheat production. Seeing their wheat production potential as high as 30mmt which would equate to an increase of 4mmt on last year’s harvest. The adjustment comes off the back of beneficial weather bringing rainfall to the cropping zones in the west and south of the country.

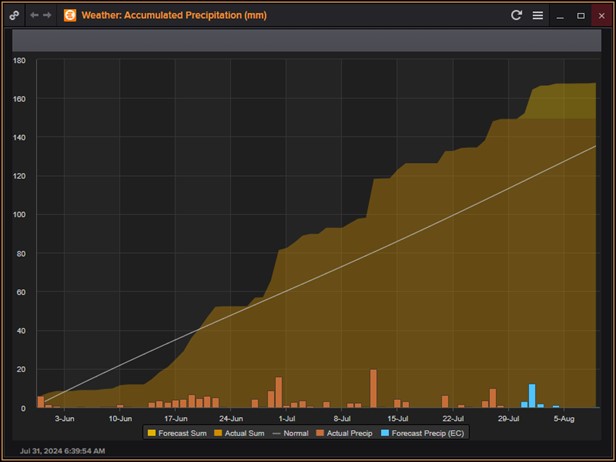

Ukraine’s grain traders’ union, UGA, has cut Ukraine’s 2024 combined grain and oilseeds crop providing some slightly more bullish news. They have forecasted a reduction of 2.8mmt leading to a total output of 71.8mmt owing to an ongoing heatwave. The union said this year’s harvest could include 23.4mmt of corn, 19.8mmt of wheat (still above the July WASDE estimate of 19.5mmt), 4.95mmt of barley, 12.8mmt of sunseed, 4.8mmt of soybeans and 4.3mmt of rapeseed. For a very different weather-related reason, but the same overall outcome, France’s producers’ group, AGPB, said yesterday following months of persistent heavy rain (shown in the graphic below – region Champagne-Ardenne) that the countries wheat crop may only reach 26 million metric tonnes this year. This would bring output down to a level not seen since the 1980s again potentially countering larger harvest elsewhere.

Source: Refinitiv

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook, Aaron Stockley-Isted and Jamie Kirkwood

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025