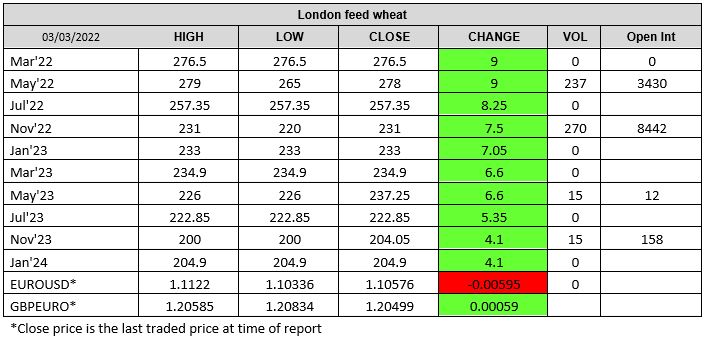

London Wheat Report

Source: FutureSource

Negotiation meetings continue between Ukraine and Russia while artillery continues to rain down, especially on Mariupol. Seems unlikely that we are going to see any real resolution out of this today, but if there is progress then ag markets would be expected to go lower. An Estonian owned ship sunk off the coast of Odessa after hitting a mine and a Bangladeshi flagged bulk carrier was hit by a missile while moored in the Black Sea port of Olvia. Expect messy trade and market volatility to continue, if the ‘special military operation’ continues, there does not appear to be a reason for a flat price to implode. In a call today, Mr Putin told President Macron that he will accomplish what needs to be accomplished by any means necessary …. Howitzers are going to continue smashing Ukrainian cities then. Brent crude remains strong, although marginally down on yesterday by 0.25%, trading at $112.58 at time of writing.

Wheat continues to be volatile. Matif May-22 hit a trading high of €368/t before settling up €25.50 on yesterday at €366.25/t. Markets are starting to question and try to find alternative sources for Black Sea wheat while the trouble continue. Algeria has said that they are looking at the possibility of acquiring French wheat in the next March tender which would be a win for the French market . CBOT wheat traded limit up again. US export sales recorded 300kt of wheat and 485kt of corn. There is also chat now in Brussels about allowing crops to be planted on set-aside acres, all aimed at alleviating an increasingly dire shortage of grains and oilseeds at this time. Defra’s rewilding plan looks like a phenomenal idea now doesn’t it.

USDA reported another 132kt of beans sold to China between crop years. Beans have struggled to join in on the rally to the full extent as seen in the wheat. Crush demand should continue to be strong and then there is the question of potential substitution for what vegoil is stuck in Ukraine and Russia. Ukraine accounts for Weather in South America is mixed. Matif rapeseed May-22 settled up €6.00 on yesterday at €809.75/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025