ADMISI London Wheat Report for 29 November

- November 29, 2021

- ADMISI Grains Team

- Follow us on Twitter @ADMISI_Ltd

London Wheat Report

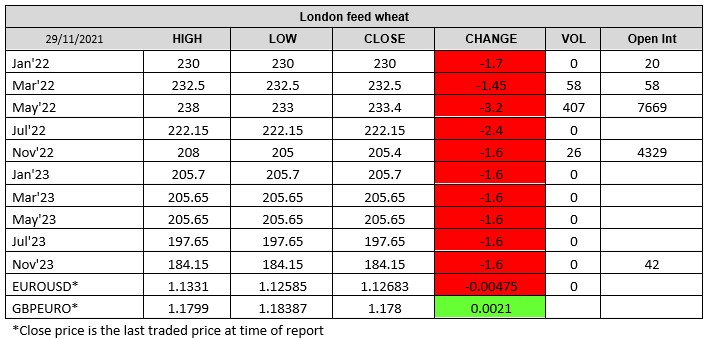

Source: FutureSource

Global ag markets continue to be under pressure due to the ongoing Covid situation. US and European wheat futures started this morning’s trade up with Chicago Dec-21 trading up around 6 cents on Friday’s settlement before making a substantial turn and pulling back significantly, trading down 15 cents at time of writing. Matif wheat also followed suit, with Mar-22 up €3 to begin with and then pulling back €3.25 on Friday’s close to settle at €297.50. The primary driver for bearish wheat markets was the Australian announcement that their 2021/22 wheat crop is to surpass all expectations and harvest a record 34.4Mmt this season. This would take it 3% above the previous record volume in 2020/21 according to the Australian Bureau of Agricultural and Resource Economics and Sciences. Heavy rainfall in eastern states and SA has delayed crop harvests and is likely to result in quality downgrades in some areas. A gap between French wheat and cheaper offers of Black Sea origins in a tender by Egypt on Monday also tempered export expectations in France. Lowest offer at Egypt’s GASC was from Romania at $350.85/t FOB for 60kt. London wheat followed international markets with May-22 settling down £3.20 on Friday at £233.40/t.

Oilseeds also followed wheat, starting the day up before pulling back. Brent crude made comeback reaching a high in today of $77.02 before falling back with last traded price at time of writing being $75/barrel. Ethanol margins are being squeezed but remain good and will most probably increase on a recovery of crude. Australia also pegged canola production at a record 5.7Mmt, 27% above last season’s high with strong oil contents seen so far in NSW. This however will still not make up the shortfall coming out of Canda where total canola exports last quarter alone (July/Sept) dropped by 1.75Mmt and shipments to the EU fell a staggering 92%. Agroconsult estimated that Brazil will have 51Mmt of beans harvested by 15th Feb, which would be the quickest on record. Prior record was 18/19 at 47.4Mmt by Feb 15th. Matif rapeseed Feb-22 settled down €10.25 on Friday at €638.25/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston, Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.