London Wheat Report

FranceAgriMer reporting updated quality results from the country’s soft wheat harvest. The published results showed test weights and protein content, both two key milling criteria, being below the average of the past five years. This is the latest blow to this year’s rain-affected soft wheat crop in France, the European Union’s biggest exporter, which is set to deliver the smallest volume since the 1980s.

Germany’s 2024 wheat crop has also suffered a similar fate, with its agriculture ministry announcing today that its wheat harvest is expected to fall by 12.7%, down to 18.80mmt. Comparable poor weather that has hampered French growers has also been felt across the border, ultimately reducing the overall European wheat tonnage.

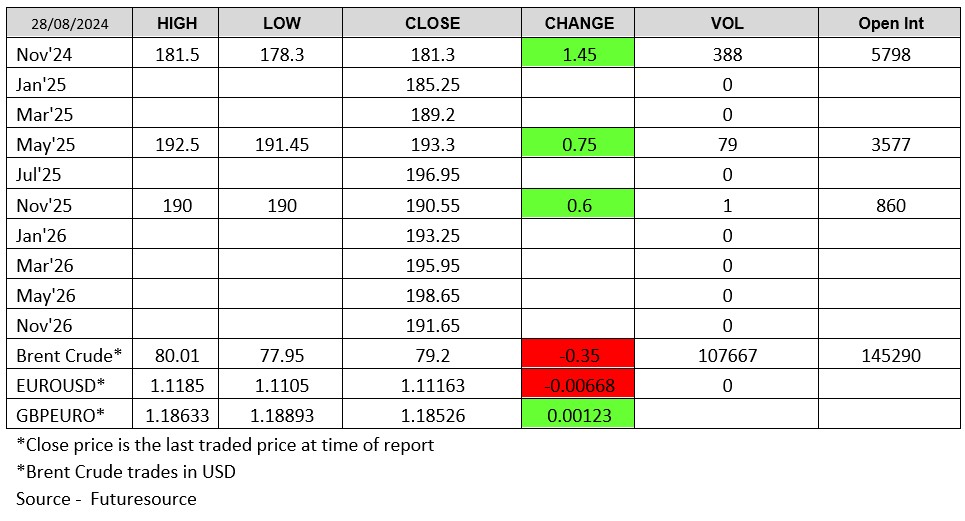

Today saw Matif Wheat claw back the past seven days losses, with the September contract finishing the day at EUR 198.50, potentially off the back of the above negative news stories. Even with some degree of recovery, there remains a large price disparity in place between the London wheat contract (blue) and the Matif milling wheat (orange) contract, highlighted the front month continuation chart below.

Source: Refinitiv

The CME and Euronext have teamed up to provide cross exchange wheat spreads, scheduled to go live on the 14th of October. These contracts are cash settled and trade independently to the underlying markets and can be accessed in USD via the CME and in EUR via Euronext.

CBOT SRW Wheat vs Euronext Milling wheat

CBOT KC HRW Wheat vs Euronext Milling wheat

In addition to these Euronext will launch a Euronext Milling Wheat Futures vs Euronext Corn Futures.

These exchange provided spreads will make these relative value trades more accessible with:

- Reduced initial margins.

- Reduced transaction costs (one trade instead of two legs)

- Avoiding the complexities of managing different currencies

- Reduced execution risk (no risk of getting legged)

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook, Aaron Stockley-Isted and Jamie Kirkwood

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025