ADMISI London Wheat Report for 27 July

- July 27, 2021

- ADMISI Research Team

- Follow us on Twitter @ADMISI_Ltd

Source: Future Source

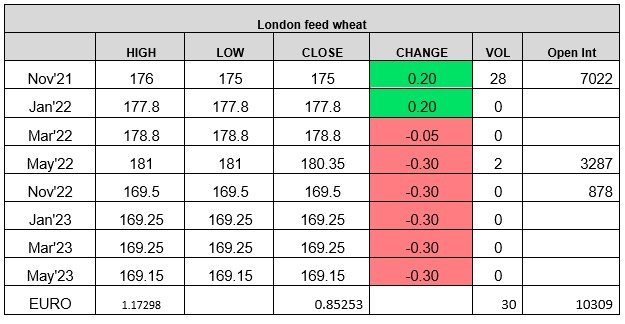

London wheat had a shocking day from a volumes perspective, trading a mere 25 lots across the board. That is uncharacteristically quiet, but perhaps a sign that the farmers are busy in the fields or maybe a sign of uncertainty of where we are heading next.

US wheat futures began the week lower in all 3 markets. Fresh news from the USDA weekly crop update saw Spring Wheat GD/EX ratings have fallen again, fallen on last week by 2 points to a record low of 9% (70% last year) and very poor has increased by 3 points on last week to 32% (2% last year). The Canadian outlook is very similar with the crop suffering the same fate. In Alberta, 39% of spring wheat is rated GD/EX versus 80% this time last year. Expectations are now moving towards a sub 25Mmt Canadian wheat crop.

CBOT Corn has had marginal support from rumours of an anticipated Chinese demand and from the USDA weekly crop report which has decreased the good condition rating by a point to 49% (55% last year). Continued forecast of heat and dryness across the Plains and W Midwest can only bring further rating declines. South American corn crops are becoming increasingly concerning, Brazilian crop losses have not yet translated into additional US exports, but have pushed demand into drought affected Argentina. Yesterday, the Argentinian govt declared a 180-day water emergency for the Parana river due to levels. Export shipping on the Parana is also running at 75% capacity due to water levels.

Euronext milling wheat futures were mixed in today’s trade. While yield expectations have been increased in the EU and Ukraine, quality is expected to have suffered. Yields from Romania suggest a record crop of up to 12Mmt (USDA 9.5Mmt, EU Commission 9.7Mmt). There are also suggestions that some regions of Russia are seeing record crops after recent crop concerns with Krasnodar’s governor stating that the region has harvested 10.5Mmt of winter wheat (5 year average 8.8Mmt).

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell & Ryan Easterbrook

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.