London Wheat Report

Source: FutureSource

Happy Monday!

Decent weekend of Rugby, depending who you support. At least Wales didn’t go on strike although going off some of their play, they might as well have. Scotland lost, shame.

So primary focus in today’s news is the apparent Northern Ireland Brexit agreement that is meant to alleviate the absolute colossal load of insanity that was the customs border in the middle of the Irish Sea. Easing of trade rules for the province is the primary element alongside the Northern Irish oversight of rules. We shall see if the DUP back this one or not and end their boycott. If this does happen, bit of political capital for Rishi right there through the ‘Stormont brake’ which would allow the regional assembly to stop any EU laws from applying in Northern Ireland. We shall wait and see. GBP strengthened against USD and EUR following the announcement.

Well, wheat isn’t looking too spicy at the moment and I can’t see current price levels getting European farmers excited to open up their store doors. Chicago has hit 5 month lows with May-23 approaching the 700 mark, will it get that low? Russian wheat continues to weigh on prices, physical offering has fallen below $300/y FOB, lowest levels in 1.5 years as competition grows, being offered at $296/t FOB 12.5% protein from Black Sea ports according to IKAR. Latest GASC tender showed this, showing Romania not being too far off the Russians. Romanian wheat is also anticipated to lower due to Romania’s wheat exports halving so far this season due to Ukrainian competition. US weekly wheat inspections came in above market expectations at 591,725t with Mexico gulping the majority.

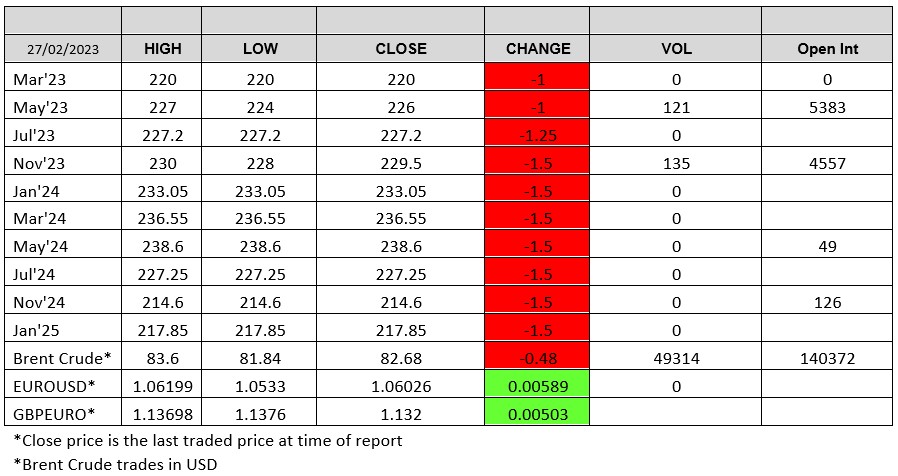

Matif wheat continued to push lower in today’s trade with May-23 settling lower again. Volumes were pretty average. London wheat followed Matif lower with quite unexciting volumes traded to start the week off. Interesting to see that May-23 hit the £242-£243 resistance level at the start of last week and has crashed straight through this to trading around the £225/£226 levels for most of today. Quite a reversal.

US weekly corn inspections have fallen to 572,622t in the week ending Feb-23 according to data from the USDA. US soybean inspections were far below expectations at 690,984t which pushed Chicago beans lower. Chicago corn continues to be pretty unexciting. Matif rapeseed was trading most of the day unchanged.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.