London Wheat Report

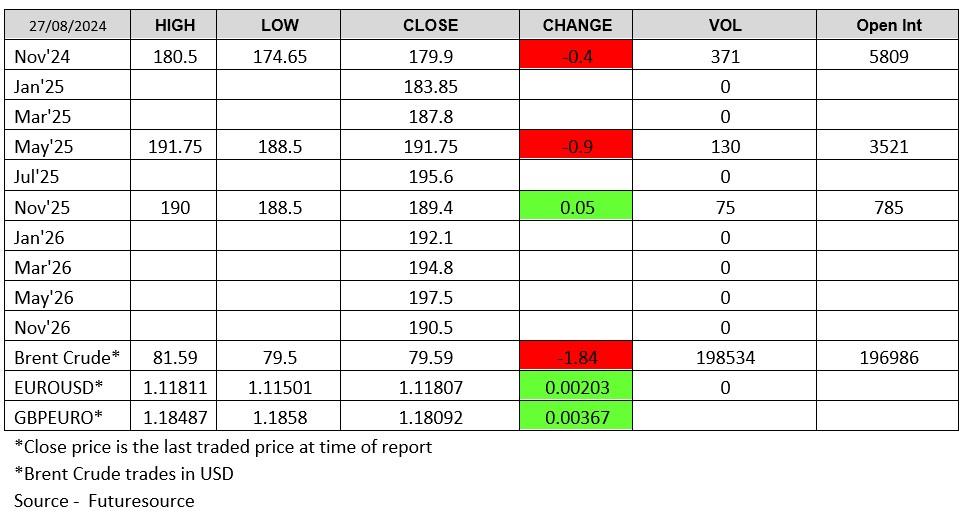

After the UK’s late summer bank holiday yesterday, London wheat was playing catch up to its Matif equivalent. The London November wheat contract dropped down to a low of 174.65 midmorning before recovering some ground little by little to finish the day at GBP 179.90. The Paris September wheat contract followed a similar path, as seen on the graph below, finishing the day EUR 193.75.

It was reported today that Jordan’s state grain buyer purchased around 60,000 metric tonnes of hard-milled wheat. The successful bidder offered the full tonnage at an estimated USD 254.50 a tonne (cost and freight) for shipment in the first half of October. This is priced marginally higher than some of the previous tenders we have seen over the past couple of months but still shows the eagerness for state buys to make the most of the lower global prices on offer. Last week saw Black Sea grain supplies continue to outcompete export demand; today’s prices suggest this pressure may remain in place for a while longer, raising the question: surely these low prices can’t live forever.

Source: Refinitiv

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook, Aaron Stockley-Isted and Jamie Kirkwood

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025