London Wheat Report

Source: FutureSource

Well, things appear to have cooled a little after yesterday’s excitement. Russia and China are attending a summit in North Korea. Rhodes fires appear to be under a form of control, although temperatures there remain at significant levels. HSBC are the first commercial lender to cut mortgage rates on their 2 year fixed by 0.1%. Market awaits the FED’s decision on whether they will refrain from raising rates or if they will continue after seeing the economic resilience.

USDA crop ratings emerged without major surprises, Corn ratings held steady at 57% G/E, while expectations were for a 1-2% increase. Soybean ratings slipped 1% to 54% G/E, in line with expectations. Spring wheat ratings slipped 2% to 49% G/E, in line with expectations. Winter wheat harvest advanced to 68% complete vs. 76% YA and the 5-year Ave. of 77%.

Wheat markets cooled off today although have remained jumpy, but have not continued their significant climb higher. Attacks overnight towards the Danube areas and loading facilities calmed, whether this is a de-escalation or a pause we will have to see but reports that barges had started to be loaded again today does show exports will flow. It very much depends on whether a ship goes down really now as this would be a step up considerably. Russian grain exports continue to flow unhindered. Volatility is set to remain and knee jerk reactions toward headlines will continue as they always have done. Export vols from Ukraine remain unaffected even with Odessa closed, as long as Danube remains open. Ukragroconsult still pegs this at circa 5Mmt/month.

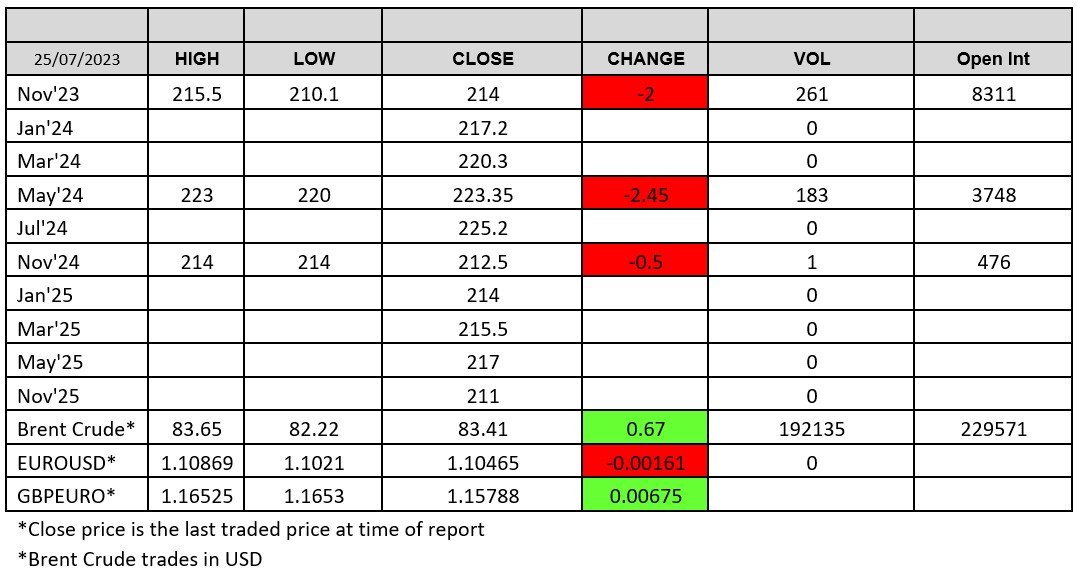

Russian harvest progress has slowed due to rains, as of 20th Jul-23 only 14% of the planted areas in Russia had been harvested compared to 22% during the same period last year according to SovEcon. European Commission announced a second delay of its weekly cereal exports and imports data till 1st August. Chicago wheat was trading marginally lower towards the end of the afternoon. Matif was also trading lower with Sep-23 trading, settling down €3.00 at €261.75.

Oilseed complex was trading lower with Chicago beans trading lower, Nov-23 beans were trading down 14 cents at time of writing around the 1410 level. Matif rapeseed Nov-23 also pushed lower, settling €10.50 down on yesterday at €478.50/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025