London Wheat Report

Source: FutureSource

Happy Monday! Well after all the political excitement over the weekend and a political saga that not even Netflix could have conjured up, we now have a new PM in the form of Rishi. Let’s see how things progress. Chinese elections also took precedent over the weekend with President Xi and his fellow minions concreting a third term in power and faces the unprecedented task of repairing a weakening economy and frosty western relations.

Saudi’s SAGO has bought 566kt at $684.75/t CIF so we can assume that it wasn’t US wheat. Algeria are back in the market for wheat for small port delivery for Nov-Dec. Matif Dec-22 wheat started out higher this morning on the Russian dirty bomb chatter being pumped out by the Kremlin’s spy chief although markets then turned bearish after initial reaction. Wheat seems to be at a sustainable level heading into year end, dependent on what war news and ideas are witnessed. GASC claims they have wheat reserves for 5 – 6 months… tender will no doubt be appearing soon. Matif Dec-22 settled down €3.00 on Friday at €339/t.

More chatter on the grains corridor with the Kremlin’s mouthpiece Lavrov shouting that they want to see final export destinations for Ukrainian exports under the current corridor prior to agreeing a roll over, sounds more like lip service than anything substantive tbh. Market seems to think that it will. Ukraine is saying 150 grain boats are being delayed by Russia currently.

EU crop monitor forecasts have been downgraded. EU22 Grain maize at 6.34t/ha VS 6.39t/ha last month, Sunflower yield at 1.97t/ha VS 2.05t/ha last month and spud yield is forecast unchanged at 33.4t/ha.

Bird flu issues continue to stem around Europe with culling continuing in both the Netherlands and Bulgaria.

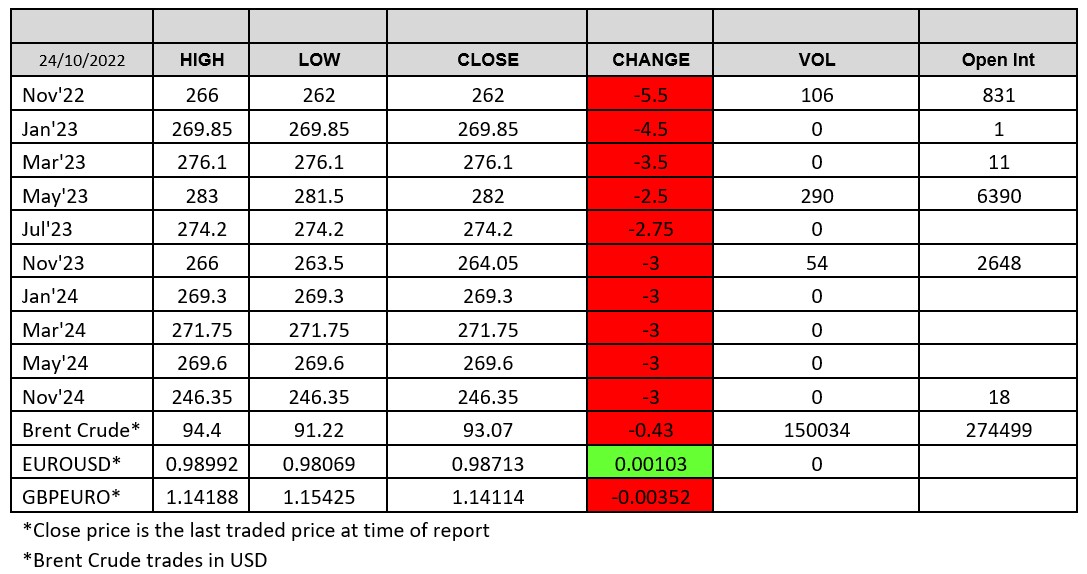

London Nov-22 first notice day is tomorrow. Open interest is currently standing at 831 lots, down from the 1063 on Friday’s close. Nov22/May23 spread was trading at -£17 today.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025