London Wheat Report

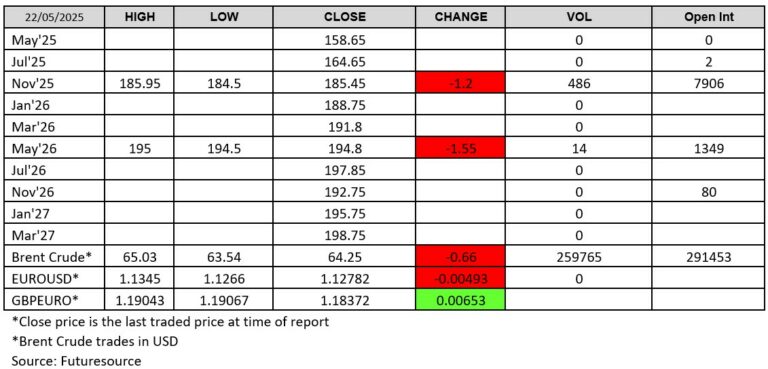

Another ‘good’ day for volumes on the Nov-25 London contract today, with market participants still making the most of prices last seen in mid-April. The May-26 contract also saw some volume pass through, following the same price trajectory as the Nov-25 contract – slightly down off yesterday’s highs. Matif wheat also had a day in the red across all contracts as it followed US wheat contracts further down.

The Chicago wheat contract fell today as a short-covering rally that took prices to a one-month peak over the past couple of days fizzled out. It was seen that there are limited threats to Northern Hemisphere crops despite news of recent adverse weather spells. Corn and soybeans also eased after three-day gains, with a steadier dollar, weaker crude oil and generally favourable crop conditions curbing the markets. After dropping to a near five-year low of $5.06-1/4 on May 13, concerns over adverse weather in Russia and China and an unexpected decline in U.S. wheat ratings triggered a wave of short-covering in the past week. However, latterly, market participants have seemingly become somewhat sceptical that both Chinese and Russian wheat crops have suffered significant damage. The US also was reported to be on track for a large harvest despite disease risks in some areas.

It was also reported today that Russia, currently placed as the world’s largest wheat exporter, has removed a minimum wheat price recommendation for its grain export traders until the end of the export season on July 1. The decision implies that grain traders can sell the estimated 3.6 mmt of wheat at a price below the recommendation. Eyes will be on upcoming wheat tenders to see just how low these prices will become.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook, Aaron Stockley-Isted and Jamie Kirkwood

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025