ADMISI London Wheat Report for 22 April

- April 23, 2024

- ADMISI Grains Team

- Follow us on Twitter @ADMISI_Ltd

London Wheat Report

Ukraine’s grain exports in the 2023/24 July-June marketing season had reached almost 39.5 million metric tons as of April 22, against 40.7 million at April 24 last year, agriculture ministry data showed on Monday. Exports so far this season have included 15.1 million tons of wheat, 21.7 million tons of corn and 2.2 million tons of barley.

The European Union’s crop monitoring service MARS on Monday raised its forecast of the average soft wheat yield in the EU this year to 5.93 metric tons per hectare (t/ha), up from an initial forecast of 5.91 t/ha forecast in March.

Russian wheat export prices decreased slightly last week amid active shipments and an expansion of the export quota for Russian grain, although dry weather began to affect harvest forecasts. The price of 12.5% protein Russian wheat scheduled for free-on-board (FOB) delivery in late May-early June was $208 a metric ton, down from $210 a metric ton the previous week.

Chicago wheat rose on Monday to hold near a two-week high as concerns over crop weather in the Northern Hemisphere encouraged short-covering. Chicago wheat was up 25 cents at the time of writing. Kansas and Minap wheat were both up 20 and 10 cents each respectively.

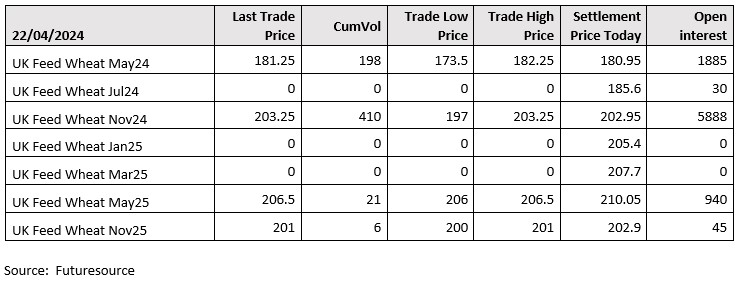

Matif and London wheat were well supported today. Matif May traded up nearly 10 Euros at one point in today’s session before calming slightly but still closing well up. London like its counterparty across the channel was up up and away. May 24 traded on close @ £182.25, a whopping £9.15. Nov 24 hit the dizzy heights of £203.25. May25 traded for 21 lots and Nov 25 also got on the board today for 6 lots between 200 and 201. Volume across the curve was strong with over 600 lots crossing the line.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook or Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.