London Wheat Report

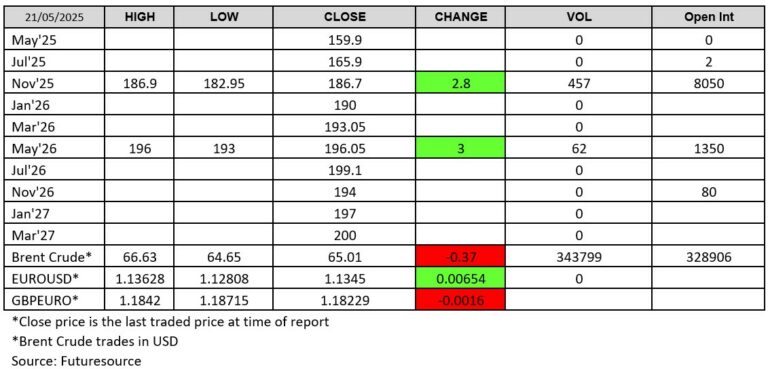

Finally a day of STRONG volume through London wheat. It would appear market participants like these slightly higher prices on screen, prompting over 450 lots to go through the Nov-25 contract, gaining £2.80 on the day. May-26 also saw a late flurry, gaining £3.00 today. Matif mirrored this also with strong volumes going through and green across all contracts come the end of the session.

Yesterday saw the news of crop concerns and resultant short covering amplified by a weak dollar after cautious Fed remarks. Today saw a similar scene with US ags having another strong day across the board. China has also seen dry weather threaten crops, especially in the wheat-producing region of Henan. Yesterday also saw news of frosts across the grain belt of Russia; however, the agricultural consultancy Sovecon has actually raised its 2025 Russian wheat production forecast to 81.0 mmt from 79.8 mmt, citing improved weather conditions in recent weeks. Russia, the world’s biggest wheat exporter, harvested 82.6 mmt of wheat in 2024 when crops were severely hit by adverse weather. Time will tell if we see a similar yo-yo-ing of bullish/bearish news stories coming from Russia again this year. It was reported by Sovecon that it estimated total grain production in 2025 at 127.6 mmt, largely up from the 125.9 mmt seen last year. It is noted that the Sovecon figure does not include the harvest from Russian-controlled regions of Ukraine.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook, Aaron Stockley-Isted and Jamie Kirkwood

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025