London Wheat Report

Source: FutureSource

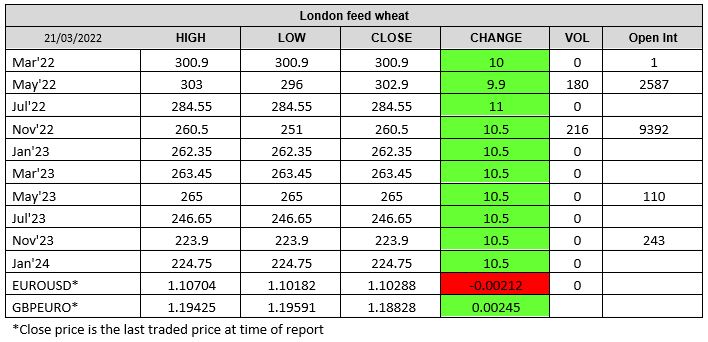

Markets added risk premium due to little confidence in Russia and Ukraine finding a path to peace, especially since the ultimatum from Moscow was rebuffed this morning regarding the surrender of Mariupol. Russian howitzers continue to pound away while taking a stronger foothold in eastern regions while expanding operations in the west. Spring cropping is already kicking off with the main session due to start shortly. Concern surrounds labour, machinery and inputs – all adds to risk premium being justified. Chicago wheat found traction today with May-22 hitting limit up earlier this afternoon before last trading up 76 cents at time of writing. Markets dipped on hopes last week of a peaceful resolution but that appears to be long in the grass for now. Ukraine’s exports are expected to remain at a stop this week. US exports rose by 7.6% this week according to the USDA. Turkey’s state grain buyer has returned for another 455kt of wheat just after purchasing around half a million previously. South Korea’s milling association purchased 45kt for May-June delivery. EU crop monitor estimate the average 2022 yield at 6.02t/ha. Matif wheat May-22 settled up €5.00 on Friday at €376.75/t and September 22 settled up €18 on Friday at €341/t. London wheat also followed global markets higher.

Volatility also continues in the corn markets with Chicago corn May-22 trading up 19 cents at time of writing. Continued disruption to Ukrainian exports ensures that US export sales remain strong. Longer term, Brazilian plantings are progressing with no new major weather concerns currently. Ukraine is looking at methods of exporting grains out of Moldova and Romanian ports via rail through western Ukraine to try and ensure exports are sustained to some decree. Matif Jun-22 corn settled up €9.50 on Friday at €334/t. Canadian Pacific Railroad locked out workers over an ongoing labour dispute which will hit the flow of commodities to export ports and of the lock out lasts longer than a week there may be issues with on-site storage filling up. |

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025