London Wheat Report

Source: FutureSource

Wheat markets began the day on the charge, overnight news that Russia have promoted Chechnya veteran nicknamed “General Armageddon’’ lead many news outlets to question if this meant Russia was any closer to using nuclear weapons over the Black Sea. This also lead others to believe what good the talks between the UN and Russia on extending the Grain Corridor passed the end of next month could actually do if nuclear weapons were on the table. Earlier in the week it was reported that talks had been positive and many believing the corridor would be extended.

Russia’s agriculture ministry has proposed setting the country’s grain export quota at 25.5 million tonnes for the period from mid-February until the end of June. As well as this, Russian Export Duty on wheat rises 52.3% to 2,900 rubles per tonne. The new duty on barley has risen to 52% to 2,479.9 and that on corn has fallen 22.6% to 2,410.1 rubles per tonne. The new duties are based on indicative prices of $308.3 per tonne for wheat compared to $307.7 per tonne the previous week, $279.8 for barely versus $280.9 per tonne, and $278.2 for corn, down from $317.6.

Wheat traders are continuing to monitor the increasingly talked about risks to supply from droughts in Argentina and the US wheat belts. Along with, as the cricket fans amongst us will know, the torrential rains in Australia which is currently holding the T20 World Cup. The torrential rains are not only interfering with the cricket, but are untimely ahead of harvest.

Throughout the day as Matif and London continued with the support, Chicago saw a complete turn around and, at the time of writing, the closest December contract was trading 10 cents down in comparison to the 12 cents up it was trading in the AM.

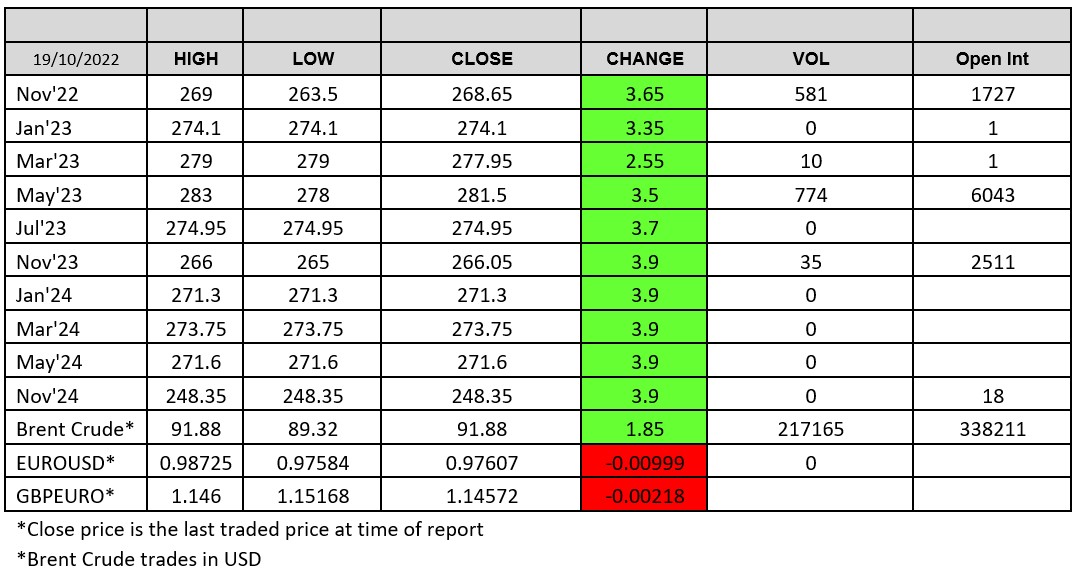

London settled up around £3.50 through the majority of the traded months. Mar 23 traded ten times to add to the already huge open interest of……1 lot. Across London wheat today the most traded month was May 23 with 774 lots trading as an outright, but interestingly it was followed closely by November 22 which is coming ever closer to the tender period. 581 lots crossed the line as an outright and a number of Against actuals/EFPs will surely see the open interest in this contract fall into hundreds, off the 1727 reported by ICE yesterday.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025