London Wheat Report

Source: FutureSource

Happy Monday sports fans! Not the most riveting day today on the markets. Xmas week in full flow with a lot of things now being kicked into the New Year. European Union nations’ energy ministers have agreed a gas price cap, a spokesperson for the Czech Republic said on Twitter today. According to officials and a document seen by Reuters, European Union countries’ energy ministers agreed that the cap on gas prices would be triggered when benchmark gas prices spike to 180 euros per megawatt hour.

Wheat markets didn’t really have a direction to follow today, both in the US or Europe. Primary chatter is on Ukrainian drone strikes and weather with little fresh news inputs for the markets to chase really. Interest in US wheat remains limited and Black Sea continues to flow. Extremely cold temperatures in the Southern Plains have triggered chatter regarding winter kill. 4 vessels carrying 145kt of wheat destined for Asia left Ukrainian Black Sea ports over the weekend.

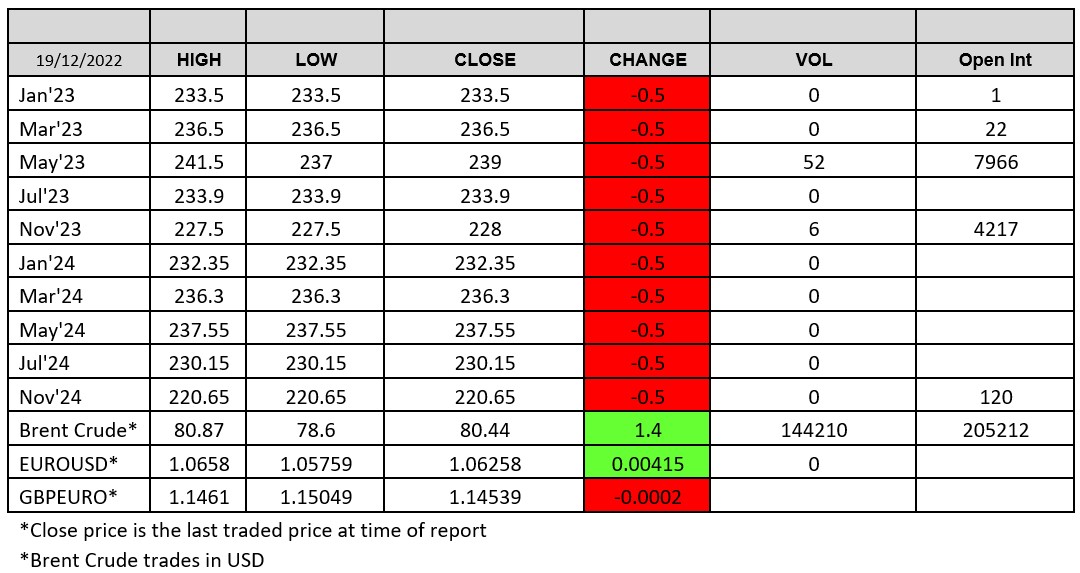

Pretty average day on Matif wheat, both volume wise and price wise with little change on Friday. London wheat really was flat out, with a cumulative total of 58 lots traded across all contracts.

USDA announced sales of 132kt of beans to unknown and 141kt of corn to Mexico. Argentina’s Roasario exchange showed improving bean conditions, with bean ratings improving by 8% to 19% due to better than expected precip last weekend. Still pretty dire when compared to 85% last year. Brazil is still on course for a mega bean crop, with potential for an increasing uplift day by day.

Ukraine’s grain area for the 2023 season is pegged at 8.7m hectares, down 22% from 2022 and 45% below the pre-war level of 2021, the Ukrainian Agribusiness Club said Friday on its website. Farmers are significantly cutting back on fertilizer use and lack financing in the midst of the war, likely curbing yields by 10%-30% versus the average. The 2023 grain harvest is estimated at 34Mmt , down 37% YOY and 60% below 2021. Oilseed plantings are estimated at 9.7m hectares, up 32% YOY and topping the grain area for the first time. Harvest pegged at 19.3Mmt, up 13% YOY.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.