ADMISI London Wheat Report for 17 January

- January 17, 2022

- ADMISI Grains Team

- Follow us on Twitter @ADMISI_Ltd

London Wheat Report

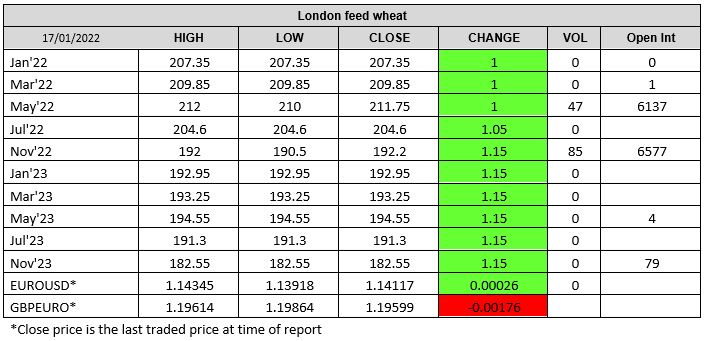

Source: FutureSource

US markets were closed today due to Martin Luther King day. Southern hemisphere bumper crop continues to weigh on the global market. Argentina remained the world’s cheapest export wheat last week, even with the 30% size-cuts on up-river cargoes. Heavy rainfall over the weekend has brought relief to Argentina’s main agricultural areas. Some relief will be felt on damaged soybean crops and areas not yet sown to be planted. Late planted corn will also benefit but the rain arrived too late for most of the early-planted corn. Aussie wheat continued to take Mid East and Asia demand. Black sea futures hit near 4 month lows but shippers were cautious about front running farmers as interior markets were stronger than export bids.

Ukraine’s Ag Ministry said that just 2.6Mmt of milling remains for export in 21/22 and traders were being ‘advised’ to switch to the export of feed grains, thereby potentially reducing world milling supply issues in the second half of the campaign. Black Sea politics looks to be the talking point currently with a recent hack against the Ukrainian government’s websites again being pointed towards Russia. Russian officials continue to make belligerent statements and the Russian financial markets are taking a hammering. Whether the possibility of an open ground invasion and numerous heavy armor rolling into the Donbass is plausible or realistic is open for debate based upon different media outlet’s viewpoints although some are more bullish towards this than others. Just to take note, in a few weeks after March-2014, after Russian forces appeared in Crimea, Chicago wheat rallied 20%. Russia’s weekly exports up twofold over the previous week (Orthodox Xmas so no surprise) to reach 1.1Mmt, still a lag on last year. Matif Mar-22 wheat settled up €2.25 on Friday at €265.75/t.

News is appearing from Agricensus over the weekend that an acute shortage of rapeseed across Germany is being realized and threatens to derail the oilseed millers profitability in the coming weeks. An estimated 1.4Mmt of feedstock needs to be secured to keep machines running. The Agricensus’ APM-26 Rape oil FOB DM Rotterdam assessment has averaged €1,632/mt since January 4, 2022, according to Agricensus data, surging nearly 90% from a year ago and among the highest prices assessed since the series was launched in 2018. Matif Feb-22 rapeseed settled down €6.50 on Friday at €763.50/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston, Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.