London Wheat Report

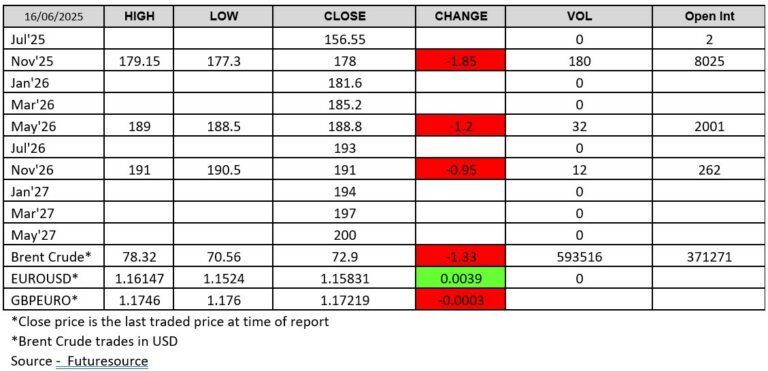

As problems in the Middle East continue, Brent Crude is currently trading down 4% after the lack of involvement from anyone else seems to have cooled the idea of an escalation involving more than just Iran and Israel. Iran has also said it is willing to negotiate a de-escalation as long as the USA doesn’t join Israel in its offensive.

It looks as though after Friday’s bounce which was bolstered by issues in the Middle East, grains are now trading back on fundamentals. Chicago wheat spent the day in the red and is trading down 6 cents at the time of writing, giving back some of its gains from Friday having closed up 16.5 cents on Friday due to the ‘’war premium’’. Matif and London wheat were also trading down all day. We will have to wait for the latest round of US crop progress reports released tomorrow to see if there is any bullish sentiment.

Soybeans continue to trade at their highest levels for 18 months after the Biofuel mandate changes released on Friday from President Trump’s administration. The U.S. Environmental Protection Agency proposed total biofuel blending volumes at 24.02 billion gallons in 2026 and 24.46 billion gallons in 2027, up from 22.33 billion gallons in 2025. This was higher than the market anticipated.

Yesterday, Algeria tendered to buy 50,000 tons of soft milling wheat with the deadline, tomorrow. The wheat is sought for shipment in two periods from the main supply regions including Europe: August 10-20 and August 21-31. If sourced from South America or Australia, shipment is one month earlier.

Corn is coming under some considerable pressure. Good weather conditions during the development of the second corn crop in Brazil reinforce expectations of high production in 2024/25. This week, Conab adjusted positively estimates for the harvesting. Double digit losses were being traded on screen today.

CFTC- COT

Activity from the speculative traders across the Ag. space was mixed in the week ended Tues. June 10th. Money managers were net buyers of nearly 37k contracts reducing their net short position to 130,239 contracts. In corn MM’s were net sellers of nearly 10k contracts extending their short position to just over 164k contracts, also the largest since Sept-24. MM’s were net buyers in all 3 classes of wheat for the 4th consecutive week.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook, Aaron Stockley-Isted and Jamie Kirkwood

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025