London Wheat Report

Source: FutureSource

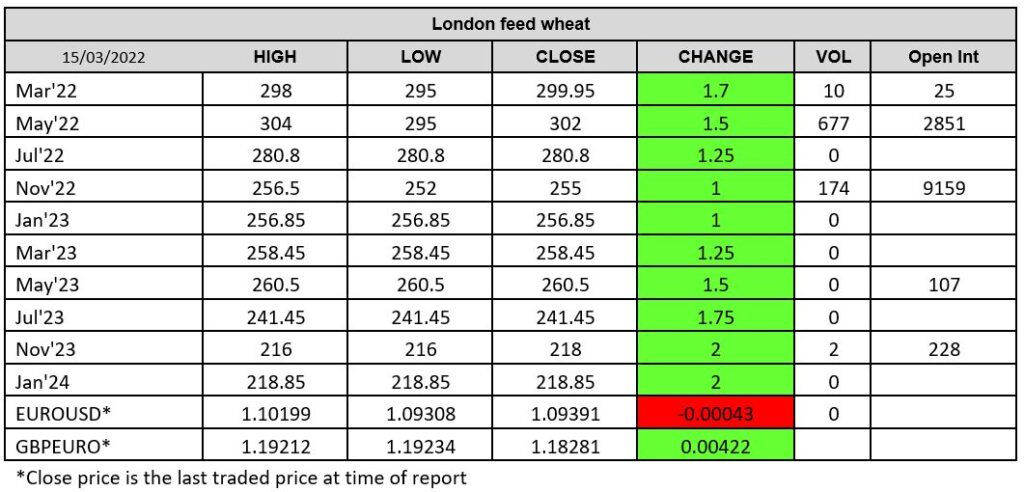

Wheat markets turned supportive in today’s trade after yo-yoing this morning. Continued murmuring of export curbs by Russia who have now officially confirmed the export grain ban to the Eurasian Economic Union, with traders now contemplating what else will be confirmed from the Kremlin. The recent decline was seen as an opportune moment for some ‘bargain buying’, if that can be said at these price levels. Chicago wheat May-22 saw some decent swings today, last trading 54 cents up at 111/bu. Concerns remain over US crop condition following drought weather in the southern US plains. US crop ratings were again mostly lower: OK rose to 24% GD/EX from 15%, but KS fell to 23% from 35%, TX is just 6% (7% last week), whilst CO is 18% against 22% last month. Japan tenders for 104kt of US, Canadian and Australian wheat.

Matif wheat found support with May-22 settling up €7.75 on yesterday at €386.50/t. Egypt is on its way to receive shipments of 189kt of wheat from Russia, Ukraine and Romania according to the Egyptian supply ministry. Egypt also purchased 30kt of wheat from France according to traders, with the Clipper Dee bulk carrier loading at Rouen. An Egyptian official source said the cargo was not destined for GASC, suggesting a sale to a private importer. London followed Matif higher. Jordan tenders for 120kt of feed barley.

Brazilian corn planting nearly complete, Ag Rural says 94%, 20% ahead of last year’s drought affected pace. Bean harvest 64% done. Spain has relaxed restrictions to allow corn imports from Argentina and Brazil. Brent crude hit a trading low of $97.44/ba before gaining back again to $100.27/ba at time of writing, still 5.55% down on yesterday. India looks set to do a mates rates oil deal with Russia. Matif May-22 rapeseed settled up €4.25 on yesterday at €902.50/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025