London Wheat Report

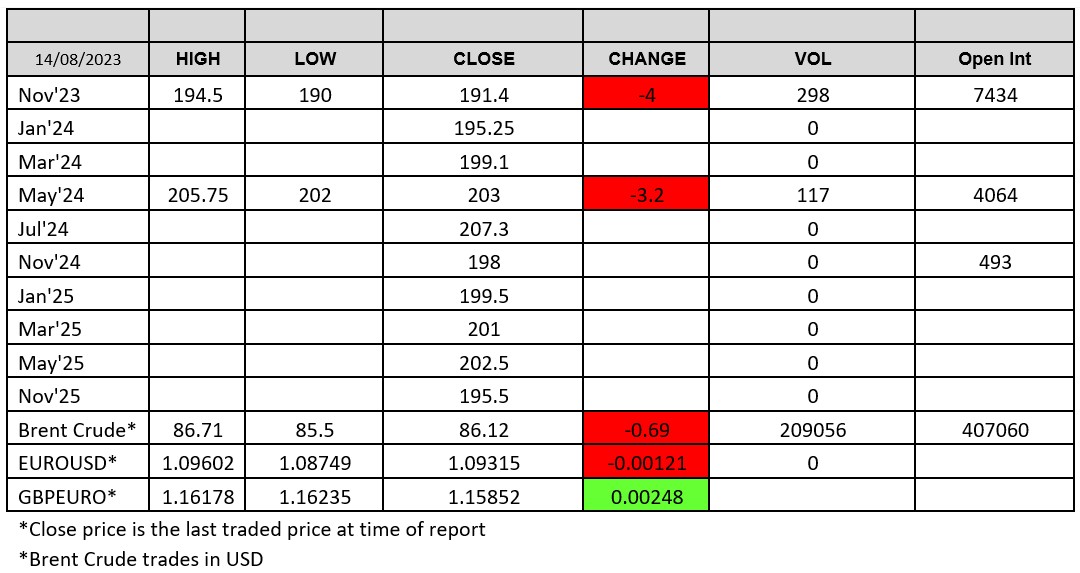

Source: FutureSource

Oh Hello Monday!

Argentina hit the headlines yesterday as a rock-singing libertarian outsider candidate gained first place in a huge shake-up in the race towards presidential elections in October, punishing the primary two parties due to the financial issues facing the Argentine economy. Ukraine starts to register ships for its humanitarian relief corridor. Russian Navy ship fired warning shots yesterday at a bulker en route to Romania who failed to stop for inspection, vessel was allowed to continue once inspected.

WASDE report from Friday, towards wheat was generally bearish. Ukraine production was upped by 3.5Mmt, exports remaining at 10Mmt. Russian exports were upped again near in line with SovEcon at 48Mmt. Market got what it was expecting. Romania aims to double the monthly transit capacity of Ukrainian grain to its flagship Black Sea port of Constanta to 4 million tonnes in the coming months, particularly via the Danube River, Transport Minister Sorin Grindeanu said. So the issues over dredging appear to have been rectified. France AgriMer reported 89% harvest complete with final 11% all in the north. Germany and Poland continue to harvest through while quality remains a question. UK harvest continues with some dry spells across the weekend. Chicago wheat was trading lower, with December trading down 15 cents at time of writing. Matif wheat Sep-23 settled down €6.25 lower on Friday at €236.50/t. London wheat also pushed lower hitting a trading low of £190/t.

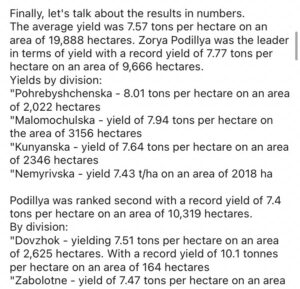

As an area of interest, thought I’d throw in a screenshot for some achieved yields from Western Ukraine from one of the large agroholdings I’ve been chatting to who farm a whopping 52k Hectares arable and have completed their 19,888ha winter wheat harvest! Pretty good numbers for over there, and amazing how quickly they are catching up with the West.

Corn markets were bearish today, in line with the carryout figures from Friday. Chicago corn Sep-23 was trading lower a couple of cents. USDA reported another juicy bean sale of 416kt of beans to unknown. Soybeans were supported in today’s trade as carryout being lowered is a positive and lots of murmuring about Chinese demand and especially into Q3/Q4 this year as some numbers being chatted are quite substantial. Matif rapeseed Nov-23 settled lower, down €9 on Friday at €447.25/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.