London Wheat Report

Source: FutureSource

Well, some interesting monetary news today. China unexpectedly cut their rates after sub-par latest data and stopped publishing their youth unemployment rates after it hit 21%. Russian central bank kicked in a 350bps rise on interest rates after murmurings from the Kremlin, with ruble hitting 102 lows to the dollar yesterday. Rates were increased to 12% with the ruble coming back up to 98 level this morning. US retail sales were up with a little help from Amazon.

USDA’s crop conditions report brought additional bearish news for both corn and beans. Corn ratings increasing 2% to 59% gd/ex. Soybean ratings increased by 5% to 59% gd/ex, a substantial jump and a bit of a surprise to the market really.

Wheat markets were lower again today with little fresh news across the board. US winter wheat harvest is 92% while spring wheat harvest is kicking off. Russian wheat harvest has passed the 50% threshold and reached the equator while the first hectares of winter wheat planting has kicked off. Russian Aug-23 wheat exports are forecast to hit 4.8-5.1Mmt, in comparison to 3.5Mm tin Aug-22 and a historic average of 4.7Mmt. Russian Ministry of Ag will need to watch out with their minimum pricing floors as the as the spread between Russian Black Sea and Rouen narrowed from $51 at the end of July to $7 by mid-August. UAE’s Al Dahara, Abu Dhabi fund have signed a $500ml deal to supply wheat to Egypt – sitting at $100m per year after their currency took a hammering.

Chicago wheat was trading down with Sep-23 trading lower, down 18 cents at time of writing around the 597 level. Matif also dropped lower, with Dec-23 trading around the €239/240/t levels towards the close. Volumes were pretty low on Sep-23 and around average on Dec-23.

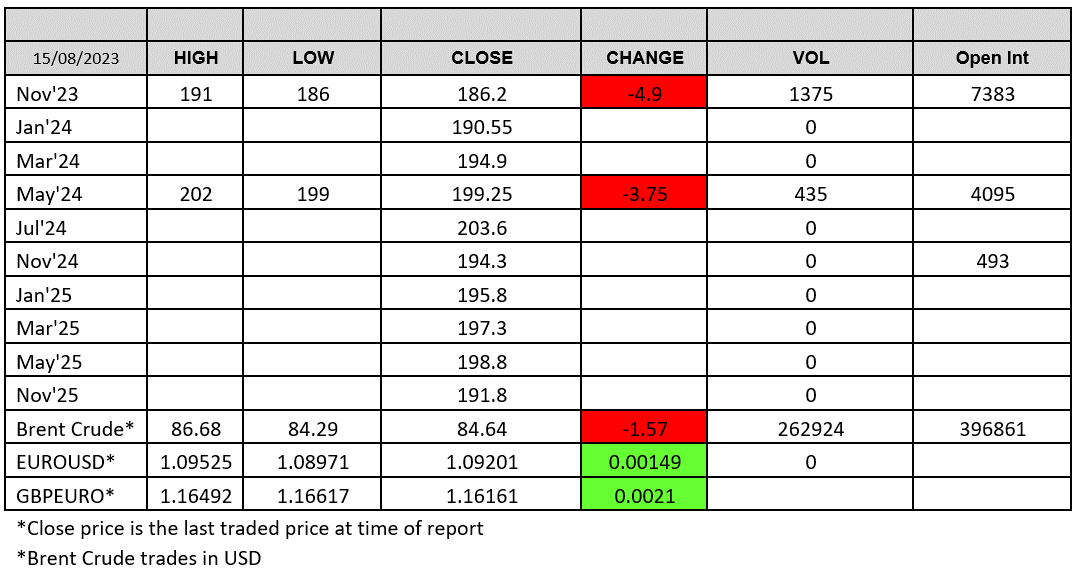

UK wheat harvest is cracking on as the weather improves with some strong thick stuff coming through in East Anglia. Reported spot physical prices delivered have been quoted around the £170/t levels in Norfolk. London wheat futures, unsurprisingly so, are pulling back with Nov-23 crashing through the £190/t levels and trading around £187/t into the close. UK Feed remains a long way off export pricing and German and Polish feed prices continue to suppress.

Corn pushed lower on the back of improved crop conditions. Front month Chicago corn fell to levels last seen on Jan 4th 2021, hitting a trade low at time of writing of 465.75. Soybeans were also pulled back on their surprising crop conditions increase. This will also effect the USDA’s bean yield downgrade inevitably so watch out for that. Matif rapeseed was supported with Nov-23 trading around the €453 level into the close.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.