ADMISI London Wheat Report for 14 November

- November 15, 2022

- ADMISI Grains Team

- Follow us on Twitter @ADMISI_Ltd

London Wheat Report

Source: FutureSource

Happy Monday!

G20 to kick the week off. Biden met President Xi for the first time since Biden took office. Lots of chatter about not letting business competition turn into conflict and no desire to have another Cold War scenario. Biden did warn China that the US would enhance security presence if Beijing couldn’t put a leash onto North Korea’s weapons programme. Ukrainian troops are in Kherson and Zelensky went to visit today.

Black Sea gains corridor news will be the primary focal point this week with the current arrangement due to expire on 19th November, Saturday this week. Russia has said that UN talks were progressive and trade anticipates that it will roll over. US railroad unions have kicked the can down the road regarding the strike action and ‘no we will not accept a 24% payrise’ malarky to next month. Yet again, insanity seems to continue here.

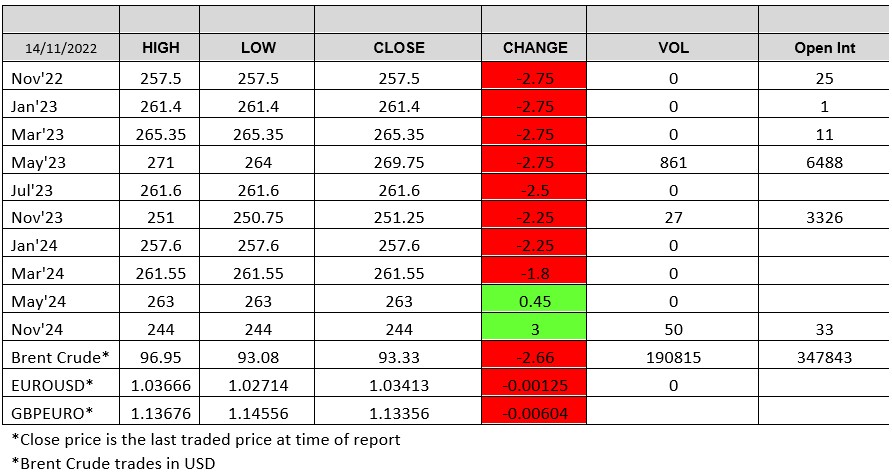

Mixed day on the wheat markets with Chicago finding some support while Matif and London were trading lower. Crop progress report out of France put a bearish tone onto wheat with wheat and barley conditions being 97-99% good. Saudi’s SAGO slammed in a stonker of a tender with over 1Mmt purchased at an average price of $382.56 overnight with mixed origin showing EU, North and South America, Black Sea and Aussie although trader are reporting that supposedly US wheat was not part of it. More tbc as the details emerge. Iraq also booked in 150kt of Aussie, Canadian and Lithuanian wheat. Aussie wheat news is sort of all over the shop depending on who’s wire you read. Quality is definitely something to keep an eye on in the land down under. Matif Dec-22 settled down €3.25 on Friday at €324/t.

London wheat had a busy day, trading a total of 679 lots across all months. Busy day on Europe’s top feed wheat contract 😉 May-23 trading a total of 602 lots today. We even saw Nov-24 trading today.

French corn harvest has concluded over the weekend, which is 28 days ahead of last year. Ethanol margins still seem to be mentioned as US corn exports are certainly not near their market potential. US weekly corn exports jump 108% to 484kt in the week ending 10th Nov according to the USDA. Soybeans were off again today, what China intend to do COVID measures wise continues on the headlines. Matif Feb-23 rapeseed settled down €10.25 on Friday at €626/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.