ADMISI London Wheat Report for 13 September

- September 13, 2021

- ADMISI Grains Team

- Follow us on Twitter @ADMISI_Ltd

Source: Future Source

US wheat market were mixed in today’s trading following Friday’s WASDE report. Friday’s report produced few surprises, not least due to the USDA’s FSA jumping the gun prematurely with their report. Both Chicago wheat and Minneapolis wheat were trading marginally down while Kansas wheat found support, with the Dec-21 contract trading up 4 cents at the time of writing. Wheat markets to remain a riddle, Canadian crops look abysmal but old stocks buffer the problem, Australia looks to have record production. French quality issues prevail and Mr Putin’s export tax mission continues at full pace, hindering export potential. Algeria’s OAIC has reportedly bought 330,000t for October in a tender and Saudi Arabia’s SAGO has bought 382,000t 12.5% what, prices to be confirmed.

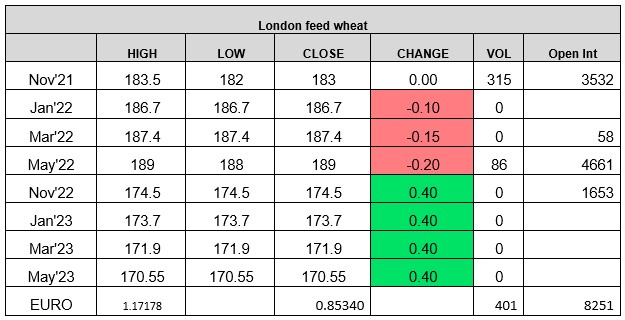

French quality woes continue, with up to 70% of French wheat only at feed standard, traditional UK wheat export homes will be extremely competitive. Only 30% of the crop is meeting the 76kg standard and 67% is meeting the minimum Hagberg 220 specification. This has added to the negativity seen in UK wheat futures last week as European markets will soon find themselves awash with feed wheat if this rings true. Prices for UK feed wheat have fallen by 8% from their mid-August peak. Milling wheat still maintains its premium on the domestic market with little sign of faltering. Matif Dec-21 settled up today €1.25/t at €239/t and London Nov-21 settled without change on Friday at £183/t.

Chicago corn remained cool today, Dec-21 was trading down a cent at the time of writing post Friday’s report. The USDA raised both US acreage and yield, adding 250Mbu to the crop whilst simultaneously raising domestic and export demand which kept the rise in end stocks to just 160Mbu. Combined with the current logistics issues, export terminals are firing back into action with some elevators up and running with the remainder due online within the next 4 – 6 weeks. Beans remained unchanged in today’s trade with little bullish news on the market to encourage support.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell & Ryan Easterbrook

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.