London Wheat Report

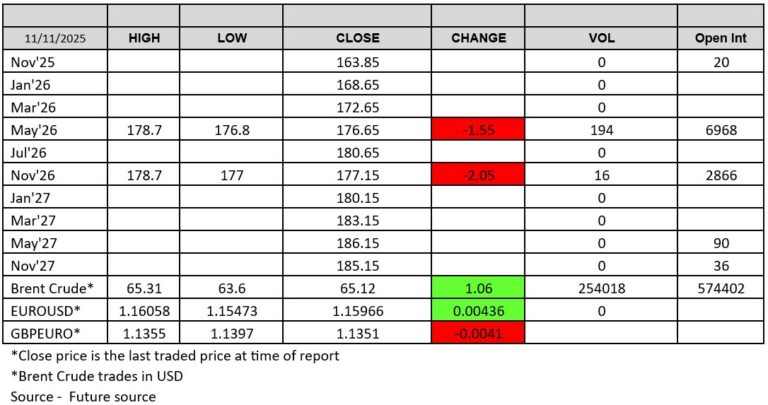

Another lacklustre day of trading across London wheat today as prices looked to remain firmly under pressure. Volumes were limited across both the May-26 and even more so on the Nov-26 contracts. This phenomenon was also seen across the Paris wheat contract, which looked to have a sluggish day also. US Ags were uninspired for the second day as traders await the first USDA WASDE since the US government shut down, due this Friday (14th Nov.). In addition, confusion surrounding China’s commitment to purchases of US agricultural products still swirled.

News today came as the Chinese state trader COFCO’s oilseed unit announced it has signed agreements to purchase Brazilian soybeans, soybean oil, palm oil and other agricultural products, with a total volume of nearly 20 mmt worth over USD 10 billion. This new statement so far makes no mention of purchases of U.S. farm goods. So far Beijing has made modest purchases of American agricultural products, including several soybean cargoes bought by COFCO as goodwill gestures seen over the past few weeks.

This absent recent Chinese buying prompted Chicago soybeans to fall for the first time in three sessions today. It has so far been 12 days since the last commitment from China to deal with US ags. According to a Reuters poll, the U.S. harvest of soybeans and corn was supposedly nearly complete as of the end of last week, with soybean harvesting 96% finished and the corn crop 92% complete.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025