London Wheat Report

Source: FutureSource

Ukraine unimpressed that they are not getting fast tracked into NATO. Russian sub commander shot on his daily run in Krasnodar, the danger of posting things on Strava. Turkey playing a bit of tit for tat with Sweden joining NATO, then Turkey joins the EU. US CPI data tomorrow. Elina Svitolina celebrates winning against Women’s World Number 1, Iga Swiatek today in the women’s, making her the first Ukrainian female tennis player to reach the semis.

WASDE day tomorrow. Plenty of short covering today ahead of it. Trade anticipates beans to be bullish, corn is predicted bearish and wheat flatlined so we will have to wait and see. Corn we are seeing as high acres, decent yields or alright yields I should add depending on who’s chatter we are running off.

Crop condition ratings came in last night with corn ratings improving 4% to 55% GD/EX. Soybean ratings were up 1% to 51% GD/EX and winter wheat ratings held steady at 40% with a 1% shift from GD to EX.

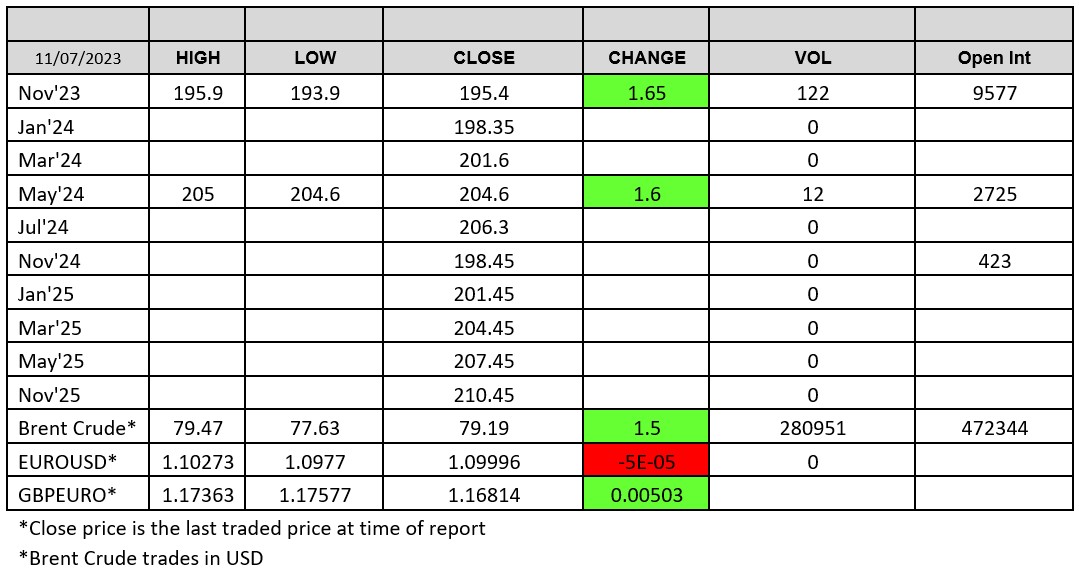

French wheat crop pegged to 35Mmt while EU wheat exports are off to a slower start for 23/24. Led by Poland with just over 360kt exported between 1st July and 9th July. EU total wheat exports for 2022/23 rose 12.5% Y-O-Y to 31.4Mmt. Bulgarian 2022/23 wheat carryover is stated at 1.03Mmt. Russian harvest is firing on all cylinders with 11.04Mmt of grains and oilseeds harvested so far from 2.94Mha. Russian wheat exports for July-23 could reach between 3.7Mmt and 4.1Mmt vs the 2.8Mmt on average according to SovEcon. Russian 12.5% FOB Black Sea is currently priced at $232.50/t. Chicago was trading up today and Matif Sep-23 settled up €3.00 on yesterday at €232.25/t, vols weren’t bad. London wheat was pulled up by Matif with Nov-23 settling higher.

Plenty of chatter yesterday about China reportedly buying 8-10 cargoes of US beans which got everyone very excited. Beans weren’t going too toppy in today’s trading though, as everyone thought they would. We are running a bit of a US centric story on the beans bull run as rest of world is pretty flat. Matif rapeseed was supported on the back of the bean run with Nov-23 settling up €7.00 on yesterday at €466.25/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025