London Wheat Report

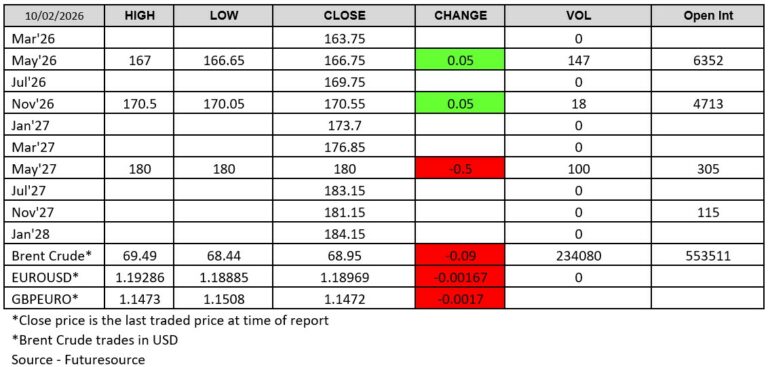

A flat end to London wheat today as all traded 2026 contracts ended the day just barely above yesterday’s levels. May-27, however, ended the day down £0.50 to £180.00. Matif wheat also ended the day flat on uninspiring traded volumes across the day.

The euro ticked down against the dollar across the day after a two-session rally that had pressured the EU wheat contract by making European grain more expensive for export. Brisk recent demand from major importer Egypt remained a market focus. Recently, talks of further sales of French wheat to Egypt have been tempered by signs that much larger volumes have been booked from Black Sea countries. This comes after estimates were announced that Egypt imported several hundred thousand tonnes of Russian wheat in January, and rumours surfaced that there was talk that Egyptian buyers were interested in Russian and Ukrainian wheat this week.

In the weekly produced EU data stream, this week showed that the bloc had exported 13.43 mmt of soft wheat since the start of the season. This figure is up 2% from a year ago; however, it is notable that some figures for some EU countries were still incomplete. In France, the agriculture ministry raised its 2026 sowing estimate for the country’s main wheat crop slightly, confirming its expectation of an expanded area compared with last year.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025