London Wheat Report

Source: FutureSource

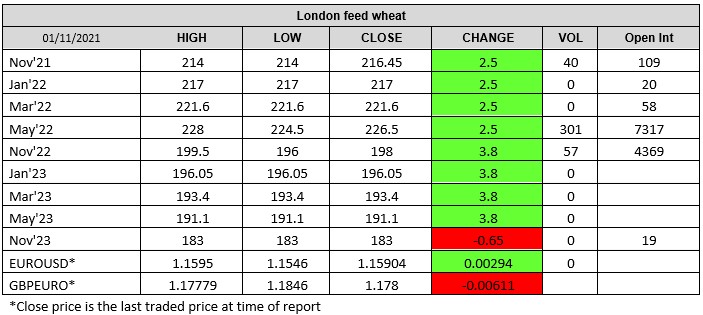

Wheat markets got hot and spicy in today’s trading as Saudi Arabia made quite an entrance, following Egypt’s GASC purchase of 360kt of wheat last week , booking 1.268Mmt of milling wheat on a 655kt tender. This seriously heated up US and European wheat markets. FOB prices for the Saudi purchase ranged $377-380/t with a mix of sources being rumored including Black Sea, USA and Aussie origins. Egypt’s GASC has returned to the market today for an unspecified amount of wheat for shipment 11-20 December. Russian wheat is coming in cheapest so far at $331.90.t FOB. Egypt are trying to quell markets by stating they have 6 months of state reserves …. Yours to decide, we all know of their book cooking habits towards stock levels. Egypt are simultaneously in talks with Citi Group to reach a deal on hedging against vegetable oil price increases. CBOT wheat Dec contract hit a trading high of 800.5/bu today (at time of writing) hitting a nearly 9 year high with similar levels not seen since December 2012. Chicago Dec-21 was last trading at up 20 cents and Kansas Dec-21 was last trading up 18 cents at the time of writing. Minneapolis was also firing on all cylinders with Dec-21 up 22 cents at time of writing. European markets followed the US higher with export demand seeing no sight of stopping. EU shipments are running at 8.9Mmt so far this season which is just over 1.5Mmt on 2020/2021 and 270kt on this point last year. This doesn’t include the French port data of boats heading off to China. Russian wheat export price continues to rise, currently sat at around $325/t FOB. It has been rising now for four months on a weekly basis except for one week in October when they took a brief pause. Export tax will not be increasing until the 9th of November due to the internal Covid issue according to the Russian Ministry of Ag. New tax is anticipated to hit $69.90/t. Matif wheat futures blazed to new highs with Dec-21 settling up €8.00 on Friday at €291.25/t and May-22 settling up €4.75 on Friday at €279.50/t. London wheat futures followed Paris higher with May-22 hitting a trading high of £228/t before settling up £2.50 on Friday at £226.50/t. These levels have not been seen since 2012 where the May-13 contract hit a trading high on the 28/11/2012 of £230/t. Nov-22 settled up £3.80 on Friday at £198.00/t. Last week’s AHDB forecast for UK wheat supply and demand showed that 2021/22 will be relatively tight yet again, especially with bioethanol plants firing back up again with strong oil prices. China booked another 132kt announced today to China by the USDA. Vessel line up remains strong as the scramble to get sales on the booked loaded out continues. USDA for November probably looking to bump both corn and bean production. Matif rapeseed support continues with Feb-22 settling up €11.00 on Friday at €689.25/t and May-22 settling up €8.00 at €669.50/t. |

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston, Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.