London Wheat Report

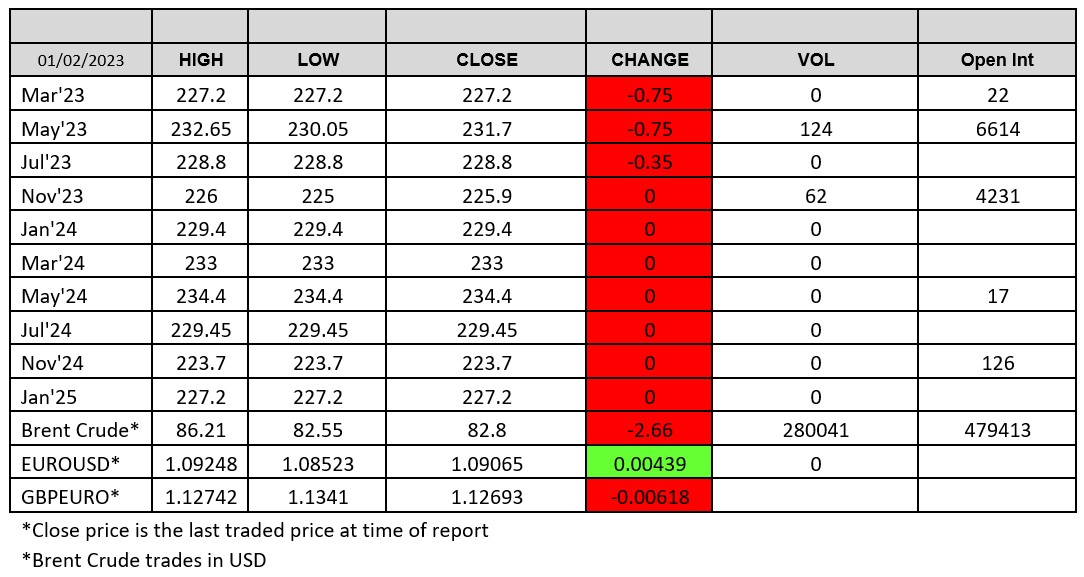

Source: FutureSource

Happy ‘hump day’!

Fed is poised to announce a 25bps raise at the rate hike later today (1900 GMT). Britain and the European Union have struck a customs deal that could help end post-Brexit wrangling over Northern Ireland, The Times newspaper said on Tuesday, and Brussels has also made a key concession on the European Court of Justice’s (ECJ) role according to Reuters last night. IMF have fired up their bullish stance to fire up the global economy

Today is national strike day in the UK, largest in 10 years apparently, how exciting. Mike Lynch and his bunch of merry men at the RMT have had a final counter pay offer by Network Rail which looks pretty good – let’s see what they vote for. Automation coming right at you. An interesting fact, quite embarrassing for Mike and the gang, is that the railway punctuality in Ukraine, a nation at war, is better than the UK rail network. Take note Avanti West Coast as nationalisation is coming to a franchise near you.

Lots of chatter that Russian sea born exports going well. Russian wheat exports continue to outpace, 20% up Y-O-Y. Russian on-farm wheat stocks were estimated to be 22.1Mmt) as of January 1, 2023, according to Rosstat data processed by SovEcon. This is 42% higher than the average for the past five years. The high stocks are expected to support active exports during H1 2023 and impact prices.

Chicago and Matif wheat were pretty subdued in today’s trade, both moving lower. London was pretty quiet and trading around the unchanged mark for the majority of the day. Export competitiveness remains a priority for UK wheat with outflows ongoing, with the significant stock position.

Chicago soybeans have pushed a lot lower, with Mar-23 trading down 21 cents at time of writing. Rains in Brazil are slowing down harvest progress and the market keeps an eye on the Argentinian weather front. Market rumours that the Chinese have bought some more soybeans from Brazil. South Korea on the market for corn. US corn was the cheapest offer to Egypt in the latest tender.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.