London Wheat Report

Source: FutureSource

More warnings of war in Niger as France evacuates citizens. Banks profits are up with HSBC posting pre-tax profit of $21.7bn (£16.9bn) for the first six months this year, compared to $9.2bn a year earlier. New UK alcohol duty regime kicks in today based on alcohol content with a new UK Treasury inspired ‘common-sense’ principles approach. Don’t think UK Treasury and ‘common-sense’ principles can be put into the same sentence, let’s be honest. And oh what a spectacle in the Ashes and farewell to Broady who bowed out brilliantly.

US crop conditions report came in within trade’s estimates with both corn and soybeans being downgraded.

Corn Condition 55% Gd/Exc (-2% WoW, -6% YoY)

Soybean Condition 52% Gd/Exc (-2% WoW, -8% YoY)

Winter wheat harvest 80% complete (+12% WoW, -3% 5yr avg)

Spring wheat condition 42% Gd/Exc (-7% WoW, -28% YoY)

Spring wheat harvest 2% complete (+2% WoW, -3% 5yr avg)

Topsoil Moisture 51% Adeq/surp (-6% WoW, -4% YoY)

Subsoil moisture 51% Adeq/surp ((-4% WoW, -2% YoY)

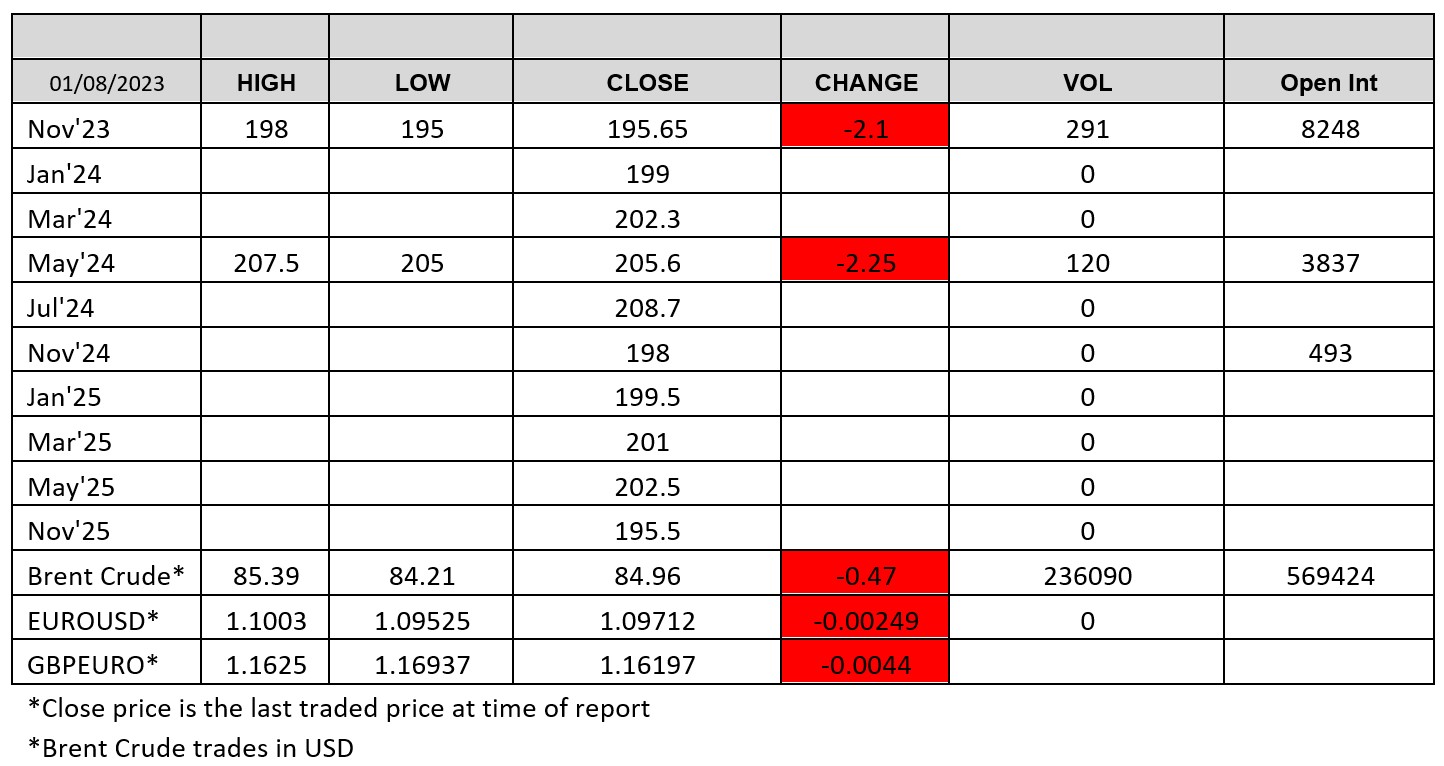

Wheat markets pushed down further again in today’s trade. Russian Black Sea out loading continues at pace with substantial volumes going through, corridor or no corridor. This is putting pressure on EU markets, not being helped by the Kremlin announcing export trade this season could amount to 60Mmt to counteract the Ukrainian disruptions. Tunisia were in today for 125kt Aug-Sept shipment. Chicago wheat kicked off the day trading around unchanged but pushed further down throughout the day, with Sep-23 trading down 15 cents at time of writing. Matif was also under pressure, although not pushing lower too much, with trading on Sep-23 sitting around the €238 level into the close. London wheat was also pushing lower with Nov-23 hitting a trading low of £195 before sitting in the £196 range.

Oilseed complex was supported today. Matif rapeseed was also trading unchanged to up. Argentine corn dollar program appears to be taking off with a reported 2.5Mmt out already. Running until the end of August, incentive is there for the farmer and should see a fair chunk moved.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.