London Wheat Report

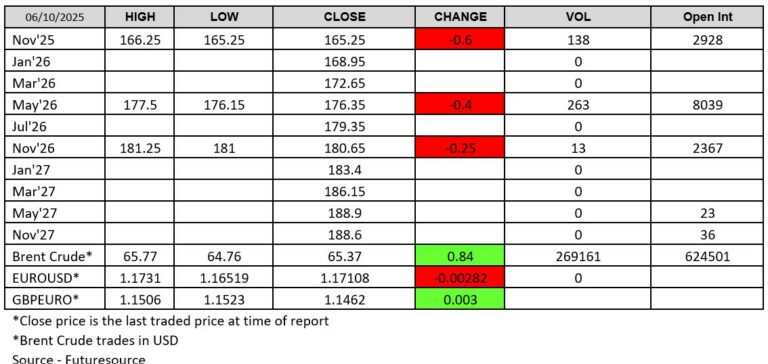

Prices could not decide which direction to head today, with all traded London wheat contracts ending the day in the red. Matif also followed Chicago’s main session turn, with the French contract also ending the day on average a euro less than the previous settlement.

It was today announced by the government of Ukraine that it has approved new documentation to accompany exports of rapeseed and soybeans that are exempt from a new duty after confusion about the levy halted shipments of oilseeds for the past month. The Ukrainian parliament passed a bill in July imposing the 10% duty on exports of the two oilseed crops, with the aim of increasing domestic processing volumes and boosting revenue for a state budget strained by the war with Russia. Rapeseed exports in September fell by nearly 59% to 201,000 mt after the introduction of the duty on September 4 and were halted for most of September. The law allowed duty-free exports for those who export oilseeds from their own production but did not provide a list of documents required for such shipments; hence, the reported fall. Ukrainian farmers have completed the 2025 rapeseed harvest, threshing 3.3 mmt of the commodity. Ukraine usually exports most of its output.

Sticking to the same region, low global prices for grains have caused a sharp fall in exports in recent months, impacting Russia’s main agricultural commodity, Deputy Prime Minister Dmitry Patrushev stated today. Wheat exports in Russia, the world’s largest wheat exporter, fell by about 30% year-on-year in August and by 10% in September, based on data from Sovecon consultancy. This fall comes despite forecasts pointing to a good harvest this year, highlighting the global nature of the price pressure weighing on the commodity.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2025 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Exceeds 5M Regenerative Agriculture Acreage Gal

September 9, 2025

ADM Reports Q2 2025 Results

August 5, 2025