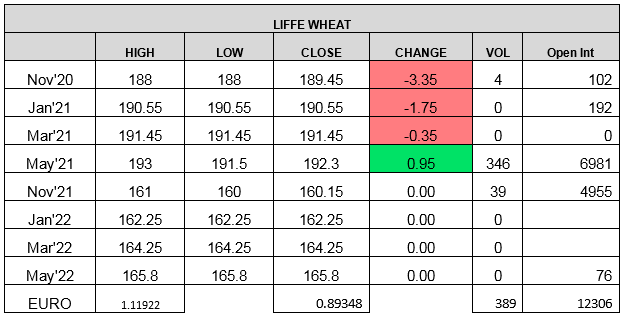

Wheat markets lower in the morning but higher in the afternoon once the US markets opened. Talk that wheat bounced off of technical support levels whilst also being very competitive on exports thanks to a USD at 30 month lows vs the EUR. The large Australian wheat crop continues to offer resistance and has pushed Aussie futures down to 13 week lows but fact that Russian winter wheat plantings are in the worst condition for 7 years (22% rated poor) helps to balance the scales.

Egypt buys 175kt of Russian and Ukrainian wheat in the latest tender, with EU wheat uncompetitive and exports down 24% on last year. It appears the higher prices have done their job.

Rain continues in south America plus a lack of Chinese buying weigh on Soybean prices. Most still believe the longer term trend is higher but some are discussing a short term downside target of $10.50. This despite the fact that 30-50% of the combined Brazil and Argentine wheat crop is said to be in drought stress. Local estimates also put the 2021 soybean crops here 2-3mmt below the recent USDA estimates.

The COT report showed speculators were holding record net long positions in corn which increases potential downside risk and is making the market nervous. Most are waiting for further news before jumping back in. US corn is currently the cheapest feed grain in the world and talk this afternoon that China may be back buying.

News that the UK Medicine Regulator approves Pfizer vaccine for use. First in the world to do so. Talk that the EU and US are not far behind. Reportedly 800,000 vaccines ready by next week with the elderly and front line health/care workers to be vaccinated first.

To subscribe to this daily report please contact the team at intl.grains@admisi.com

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook & Daniel Leeson

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2020 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.