Beans and rapeseed surge higher once again, with Soybean prices up 45% since April and may look to test the $12.085 highs of June 2016. Corn also looking to post a higher close for the 4th consecutive day, pushing up to the highest level since January. A weaker USD and hopes of further Chinese buying demand were supportive. Fact funds now have the largest combined bean and corn position since 2012, suggesting expectations of a similar drought year.

Talk of improving conditions in the US and big yields in Australia may have pressured wheat this week, as does the short wheat hedge vs long Corn and beans strategy.

Australian wheat becoming very competitive into Asia and the Middle East markets in place of US, BS and EU wheat. However the trade spat with China continues. Wheat crop estimates here range from 28.5mmt (USDA) to 34mmt.

Talk of German wheat factoring into traditional French wheat destinations (Algeria) but in general the EU is slowly pricing itself out of export competitiveness. Domestic users of Russian grain are still calling for stricter export restrictions despite the 15mmt quota announcement as prices there remain at all-time highs. Fact that both Russia and Ukraine are reporting 5% increases in winter wheat planted areas could eventually weigh on prices and offset some of the dryness impact on yield. However, talk of taxes here and higher EU prices suggests little downside for US wheat prices short term, especially with higher corn prices. Growing Australian competitiveness could be the caveat here.

News that Pfizer finds vaccine 95% effective in final trials and calls for emergency approval may have also supported prices today. Fact covid cases and related deaths continue to increase in the west will have weighed.

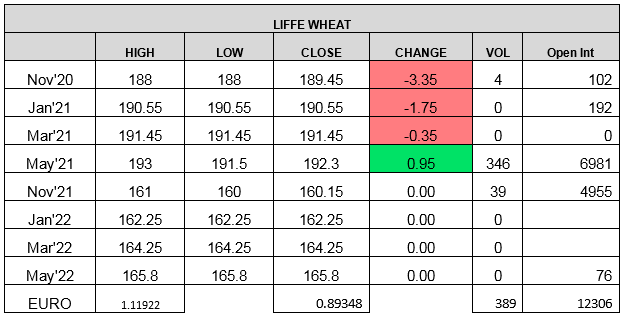

UK wheat market very much a follower today with little fresh news here. A stronger GBP may have sheltered London from outside gains somewhat. Physical wheat market remains quiet. Barley discount to wheat still +£40/t and talk of decent barley exports continuing into the new year.

To subscribe to this daily report please contact the team at intl.grains@admisi.com

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook & Daniel Leeson

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 4th Floor Millennium Bridge House, 2 Lambeth Hill, London EC4V 3TT. A subsidiary of Archer Daniels Midland Company.

© 2020 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.