A new week and prices began as expected, higher under the belief that China would be back buying at least another 2mmt of US corn at some point this week. However prices turned weaker this afternoon, perhaps from the absence of such buying or from large scale profit taking following such a rise last week.

China bought a huge 5.85mmt of US corn last week, pushing prices up over 45cents and the market into overbought territory. These purchases included the single largest daily purchase of corn since 1991, and pushed Chinese imports above the 17.5mmt estimated by the USDA. The strength in Corn may have helped wheat as demand is growing and the price spread narrowing. Higher corn prices, which may exceed $6.00/bu if some analysts are to be believed based on tight carryouts, will mean a battle for US acres come the spring as producers consider switching from wheat over to beans or corn.

Although a drier forecast for South America is creeping back in, wet weather in brazil is delaying the soybean harvest and pushing demand north to the US. This potential switch of 50-100million bushels could threaten to put US soybean carryouts below pipeline supply and push prices back up towards the $15.00/bu mark (supposedly).

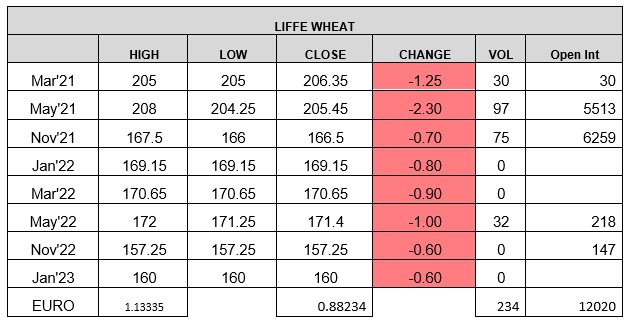

EU wheat still needs to ration demand, especially with talk that Russia may introduce a $70/t export fee sales above $200/t from the 1st June. However prices followed global markets lower today, as did London wheat prices. Demand here in the UK appears to be lacking, at least short term, with Feb/Mar milling wheat premiums coming under pressure from lack of buyers.

To subscribe to this daily report please contact the team at intl.grains@admisi.com

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook & Daniel Leeson

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.