London Wheat Report

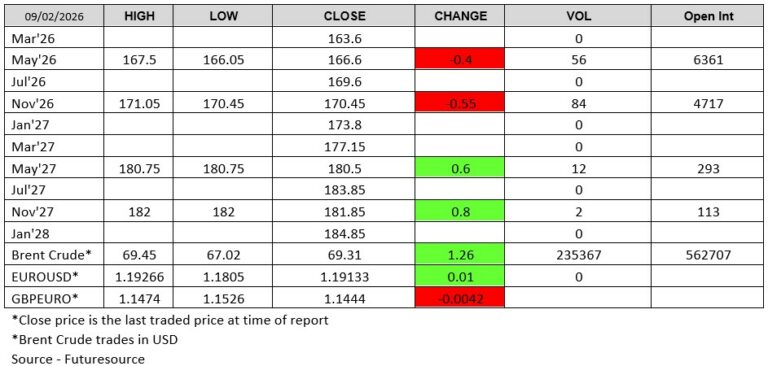

A day of red to start the week with all near-dated traded London wheat contracts ending the day down on Friday’s close. The exception to the rule was the 2027 expiries (both May-27 and Nov-27 ending the day fractionally higher, albeit carried on slim volumes). The May-26 London wheat contract saw new contract lows today (£166.05), almost a year to the day that saw the contract’s highest traded price (18 Feb 2025 – £207.75). Matif wheat also ended the day further into the red, following the global theme downwards.

Matif, the main European wheat futures contract, ended the day at its lowest in more than a week as a stronger euro dented export prospects and concerns about cold weather damage to northern hemisphere crops subsided. The euro rose against a broadly weaker dollar, making European grain more expensive for export at a time of strong competition from the Black Sea region and Argentina. Recently reported warmer weather in Germany continues to ease fears about winter damage following double-digit frosts at the beginning of the month. However, it has been reported that canals in north and central Germany were often still frozen, disrupting inland waterways shipping.

Further west, CBOT wheat looked to be choppy today as market participants squared positions ahead of the U.S. Department of Agriculture’s world crop and inventory reports due tomorrow. Increased demand from importers and bad weather in ports supported export prices for Russian wheat last week, offsetting forecasts of a strong new harvest.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025