London Wheat Report

In the MY 2024/25, exports of the US soybean complex grew significantly due to rising global demand, expanded market access, and competitive pricing. According to the U.S. Soybean Export Council (USSEC), total shipments of soybeans, soybean meal, and soybean oil reached 68.7 mln tons, up 13% from the previous year and 2.9% above the five-year average. The total value of exports amounted to $29.6 bln.

AgRural consultancy has raised its forecast on Brazilian beans from 180.4M tons to 181MMT. Expectations remain for a bumper crop continue, but hot, dry weather in Rio Grande do Sul state “needs to be monitored closely.” The harvest has hit 4.9% of the 2025/26 crop. The same consultancy also increased its Corn outlook slightly.

Bad weather in the Black Sea has caused Russian wheat export prices to rise for the second week running. The price of Russian wheat with 12.5% protein content for free-on-board (FOB) delivery at the beginning of March was $229.0 a metric ton at the end of last week, up $1.50 from a week earlier.

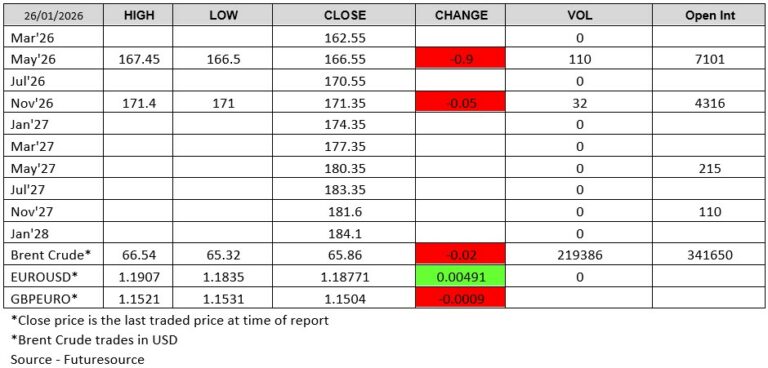

Wheat traded down today after Friday’s short covering took the market higher. While weather issues are starting to gain some traction, these are currently unable to outweigh abundant global wheat supplies. May6 London traded to contract lows of £166.50.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

The Ghost in the Machine Q4 2025

December 22, 2025

ADM Reports Third Quarter 2025 Results

November 4, 2025