CORN

Prices were down $.12-$.24 closing near session lows. Spreads also eased. Dec. 1st stocks were a record high at 13.282 bil., 320 mil. above expectations. Implied usage in Q1 was also a record high at 5.298 bil. Dec. 1st stocks/Q1 usage at 2.51 was actually a 4 year low. The role of the market is now to find a price level that keeps US demand strong while also trying to restrict additional 2nd crop acres in Brazil. US production rose 269 mil. bu. to 17.021 bil., 470 mil. bu. above expectations. Harvested acres were revised up 1.21 mil. to 91.258 mil. The Ave. US yield rose .5 to 186.5 bpa, odd considering yields were cut in IA, IL, IN, NE and OH. Yields rose in KS, KY, LA, MN, MO, ND, TX and WI. Demand rose 90 mil. to a record 16.370 bil. while US ending stocks were up 198 mil. to 2.227 bil., 255 mil. above expectations and a 9 year high. World stocks surged 11 mmt to 291 mmt vs. expectations of 280 mmt. Chinese production rose 6 mmt to 301 mmt.

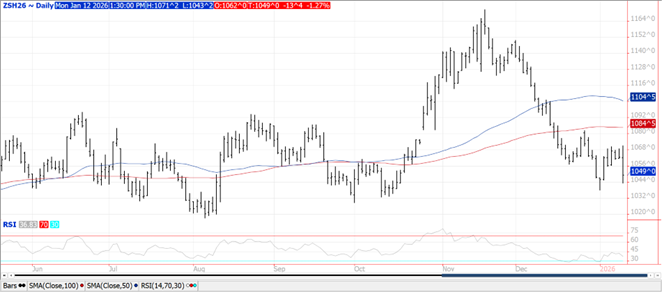

SOYBEANS

Prices were mixed with beans down $.10-$.15, meal was down $5 while oil recovered 50-60 points. Bean and meal spreads weakened while oil spreads firmed up. Spot board crush margins jumped $.10 to $1.60 ½, a 3 month high. Bean oil PV shot up to 45.7%. Once China has secured 12 mmt of US beans, domestic prices will need to become more competitive in the global marketplace or risk further cuts to the US export forecast and higher stocks. US production rose 9 mil. to 4.262 bil., 30 mil. bu. above expectations. Harvested acres were up 124k to 80.437 mil. while the Ave. yield was unchanged at 53 bpa. Total demand was cut 43 mil. bu. with exports down 60 mil. while crush rose 15 mil. Dec. 1st stocks at 3.290 bil. bu., were 40 mil. above expectations. Dec. 1st stocks/Q1 usage at 2.53 is a 6 year high. US ending stocks rose 60 mil. bu. to 350 mil. 55 mil. above expectations. Bean oil usage for biofuels was slashed 700 mil. lbs. to 14.8 bil. partially offset by exports up 300 mil. lbs. and other domestic use up 150 mil. lbs. Global stocks up 2 mmt to 124.4 mmt vs. expectations of 123 mmt. Brazil’s production was raised 3 mmt to 178 mmt which was mostly absorbed by higher exports and crush.

WHEAT

Prices ranged from $.02-$.06 lower with MIAX futures holding up the best. While today’s USDA data certainly wasn’t bullish, it wasn’t near as bearish as for corn. Mch-26 CGO futures surged $.18 vs. Mch-26 corn taking the premium back out to $.90 bu. US ending stocks rose 25 mil. bu. to 926 mil. due to lower feed usage, 30 mil. bu. above expectations. Dec. 1st stocks at 1.675 bil. bu. were 40 mil. above expectations. Dec. 1st stocks/ Q1 + Q2 usage at 1.35 matches YA. Global stocks rose another 3.4 mmt to 278 mmt vs. expectations of 276 mmt. Production was up 3.5 mmt in Argentina to 27.5 mmt and up 2 mmt in Russia to 89.5 mmt. US winter wheat acres at 33 mil. were down 150k from YA vs. expectations of 32.4 mil. White wheat acres were down nearly 170k while HRW and SRW near unchanged.

Charts provided by CQG

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Reports Third Quarter 2025 Results

November 4, 2025

The Ghost in the Machine Q3 2025

October 6, 2025