TOP HEADLINES

Biggest Argentina Wheat Crop on Record Drives Logistics Frenzy

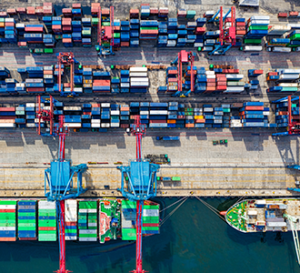

A record wheat crop in Argentina is spurring a logistics frenzy to get harvests to grain terminals and helping to keep global prices at around multi-year lows.

With fieldwork in full swing, production is seen at 25.5 million metric tons, the Buenos Aires Grain Exchange confirmed on Thursday, easily the most in data going back to the start of the century.

As a result, farmers’ truck deliveries to Argentina’s river shipment hub in Rosario were a record in November, notching almost 2 million metric tons, double the average of recent years, the city’s board of trade said in a Friday report.

That’s driven prices paid to the farmers in Argentina to an eight-year low, compounded by discounts for poor protein levels, Rosario said. For global buyers, Argentina free-on-board prices, at $206 a ton for January delivery, according to Commodity3, are cheaper than many rivals, including the US, Australia, Russia and France.

Despite low prices which the Argentine glut is exacerbating, proceeds from exports that could reach 16 million metric tons are seen at $3.5 billion, the second-most on record, Bruno Ferrari, an analyst at Rosario bourse, said in an interview. That will help efforts by the government of Javier Milei to stabilize the peso.

FUTURES & WEATHER

Wheat prices overnight are up 1 in SRW, down 1 in HRW, up 0 in HRS; Corn is unchanged; Soybeans down 6 3/4; Soymeal unchanged; Soyoil down 0.35.

Markets finished last week with wheat prices up 2 1/2 in SRW, up 5 in HRW, down 0 in HRS; Corn is up 1/4; Soybeans down 29 1/2; Soymeal down $7.40; Soyoil down 1.01.

For the month to date wheat prices are down 1 3/4 in SRW, up 2 3/4 in HRW, down 0 in HRS; Corn is down 3; Soybeans down 39 1/4; Soymeal down $12.00; Soyoil down 0.71.

Year-To-Date nearby futures are down 2.0% in SRW, down 6.4% in HRW, down 2.4% in HRS; Corn is down 4.7%; Soybeans up 10.0%; Soymeal down 1.2%; Soyoil up 28.4%.

Chinese Ag futures (JAN 26) Soybeans down 4 yuan; Soymeal down 35; Soyoil down 4; Palm oil up 20; Corn down 24 — Malaysian Palm is down 59.

Malaysian palm oil prices overnight were down 59 ringgit (-1.42%) at 4093.

There were changes in registrations (-3 HRW Wheat). Registration total: 34 SRW Wheat contracts; 124 Oats; 80 Corn; 1,131 Soybeans; 810 Soyoil; 224 Soymeal; 151 HRW Wheat.

Preliminary changes in futures Open Interest as of December 5 were: SRW Wheat up 251 contracts, HRW Wheat up 823, Corn up 8,511, Soybeans down 11,941, Soymeal down 8,857, Soyoil down 11,709.

DAILY WEATHER HEADLINES: 08 DECEMBER 2025

- NORTH AMERICA: Warm weather expected in the West and South, cooler across the rest of the country during the 10-day outlook. Wet spells limited to the Northwest and Northern Plains, with dry conditions elsewhere.

- SOUTH AMERICA: Pampas stays cool with below-normal rainfall, while Central Brazil experiences wet conditions and cooler temperatures.

- EUROPE: Warmer-than-average temperatures are expected across Europe over the next 15 days, with most regions experiencing below-normal precipitation, except U.K., northern Spain, and Scandinavia.

- ASIA: Asia will see mostly near-normal to cooler temperatures over the next 15 days, with mixed conditions in China. Above-normal rainfall is expected in Southeast Asia.

RAINS MAY SLOW EARLY CORN AND SOYBEAN PROGRESS ACROSS BRAZIL, WHILE THE PAMPAS REMAINS DRY

What to Watch:

- Dry weather across the Pampas

- Heavy rains in Central Brazil, while dry in far Southeast Brazil

Brazil: Heavy rain has fallen in central and northern Brazil over the last week, which has been sorely needed for developing to reproductive soybeans. Soil moisture is still favorable farther south, but showers are coming at a slower pace. There will be a stronger system moving through Monday and Tuesday that should bring through some widespread rainfall, though. Conditions are either favorable or improving.

Argentina: A system started moving through on Sunday and will exit on Monday, but is producing patchy rainfall outside of the north that should get some heavier rainfall on Monday. Though the pattern has been slower with rainfall chances, soil moisture is still favorable after good spring rainfall. A couple of chances for patchy rainfall continue this week, but rainfall is coming at a below-normal pace. Issues with some areas getting too dry for developing corn and soybeans will be a concern with time.

Northern Plains: Scattered snow moved through over the weekend with a clipper system. Three more clippers will move through this week with almost daily precipitation. Some areas of heavy snow will be possible as well. Though temperatures will be rather warm to start the week, more cold air is on the way with another arctic blast for late this week.

Central/Southern Plains: The storm track is to the north this week, allowing some warmer air into the region. However, a strong cold front will move through on Wednesday and Thursday with some cooler air and then another strong push on Friday with even colder air. That should be brief though as warmer air moves in next week. The fronts may bring through some limited showers across the north.

Midwest: A clipper moved through over the weekend with some moderate snow and another round of colder air. At least three more clippers will move through this week with variable precipitation, but chances for some more moderate snow, breezy winds, and reinforcing shots of cold air. Some warmth will move through early this week, but another clipper will put an end to that midweek. Another blast of extremely cold arctic air is forecast again by the end of the week, but will only last a couple of days. There are chances for bigger systems next week.

Delta: Recent precipitation in the Midwest has come with a lot of snow, which will slowly leak into the Mississippi River system throughout the winter. The pattern favors clippers this week, keeping the Delta region dry and promoting slow falls in water levels on the rivers. There is some chance for bigger systems next week, but the slow fall in water levels remain a concern for transportation.

Europe: A system moved through northwestern areas over the weekend with widespread rainfall for the UK, France, and Germany, maintaining good soil moisture for dormant winter wheat. The Atlantic stays active, bringing more showers through these areas this week while warmth spreads across the continent. Some showers will go through Spain as well, favoring winter wheat there. Warm and drier conditions across Italy and the Balkans will be unfavorable for winter wheat, though soil moisture is still relatively favorable here and concerns about dryness are minimal for now.

Black Sea: Systems moving across northern Europe may bring some showers through the region this week, though amounts look rather light for most areas. Dryness and drought are still a major concern this winter as wheat went dormant late and largely in questionable condition. Some southern areas are still too warm for dormancy, with above-normal temperatures continuing this week.

Australia: Some limited showers went through this weekend, but many areas stayed dry, continuing mixed conditions. Wheat and canola are being harvested while cotton and sorghum are being planted and going through early growth. Some showers will be possible in northeastern growing areas this week, but very little is forecast elsewhere as conditions will continue trending downward in many areas.

The player sheet for 12/5 had funds: net sellers of 2,500 contracts of SRW wheat, sellers of 5,000 corn, sellers of 10,500 soybeans, sellers of 3,000 soymeal, and sellers of 3,000 soyoil.

TENDERS

- SOYBEAN SALES: The U.S. Department of Agriculture on Friday confirmed a “flash” sale of 462,000 metric tons of U.S. soybeans to China for delivery in the 2025/26 marketing year. Some traders had anticipated such news after talk about potential sales swirled in trading market circles earlier this week.

PENDING TENDERS

- RICE TENDERS: Bangladesh’s state grains buyer has issued multiple international tenders to purchase 50,000 tons of rice, with price offers due on November 20, December 1, December 9 and December 15, European traders said.

- RICE TENDER UPDATE: The lowest price offered in a tender from the Trading Corporation of Pakistan to purchase 100,000 metric tons of rice for supply to Bangladesh was estimated at $394.95 CIF liner out, European traders said. The deadline for submitting price offers was November 28.

- WHEAT TENDER: Jordan’s state grain buyer issued an international tender to buy up to 120,000 metric tons of milling wheat that can be sourced from optional origins, European traders said. The deadline for the submission of price offers is December 9.

- BARLEY TENDER: Jordan’s state grains buyer issued an international tender to purchase up to 120,000 metric tons of animal feed barley, European traders said. The deadline for submission of price offers is December 10.

- RICE TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 58,244 metric tons of rice to be mainly sourced from China, European traders said. The deadline for the submission of price offers is December 11.

TODAY

Ukraine 2026 Wheat Harvest Seen 7% Higher at 24.6m Tons: SovEcon

Ukraine’s 2026 wheat harvest is estimated at 24.6m tons, roughly 7% up from the previous season, agriculture consultancy SovEcon said in its first estimate for the next crop.

- That compares with SovEcon’s latest forecast of 22.9m tons for 2025

- Higher volume mainly due to expected increase in winter wheat area, broadly favorable crop conditions

- That would be the country’s largest crop since 2022

- Estimates the 2026 winter wheat area at 5.2m hectares, up from 5m in 2025

- Total wheat yield seen at 4.58 t/ha, about 3% higher than in 2025

- “Recent ample precipitation created challenges for harvesting Ukrainian corn and for winter sowing in parts of Romania and Bulgaria, but it noticeably improved winter wheat conditions in Ukraine — strengthening the outlook for the 2026 crop,” said Andrey Sizov, head of SovEcon

APK-Inform ups Ukraine’s 2025 grain crop forecast to 60.6 million tons

Analyst APK-Inform has increased its forecast for Ukraine’s 2025 grain harvest due to higher than expected wheat and corn production, it said on Saturday.

The consultancy predicted Ukraine could harvest 60.6 million metric tons of grain, including 23.2 million tons of wheat and 30.5 million tons of corn.

China set for record 2025 soybean imports on Brazil buys, US trade truce

China’s soybean imports reached their highest November level since 2021, a Reuters calculation based on customs data showed on Monday, with full-year arrivals set for a record amid strong purchases from South America and a U.S. trade truce.

The world’s top soybean buyer brought in 8.11 million metric tons in November, the General Administration of Customs said, up 13.4% from 7.15 million tons a year earlier.

In the first 11 months of the year, China’s soybean imports rose 6.9% from a year earlier to 103.79 million tons, the customs data showed. November shipments were down 14.5% from October.

“November soybean imports came in slightly below our expectations,” said Rosa Wang, an analyst at Shanghai-based agro-consultancy JCI.

“Looking ahead to (full year) 2025, we expect China’s soybean imports to reach a record high – potentially exceeding 110 million tons – driven by strong commercial buying from Brazil as well as arrivals of U.S. soybeans.”

China’s soybean imports have set records from May through October of this year, as buyers sharply boosted South American purchases, fearing a shortfall if the trade war with Washington continued, which later contributed to oversupply.

“Soybean and soybean-meal inventories at domestic crushers are currently high, adding selling pressure,” said Wang Wenshen, an analyst at Sublime China Information.

Wang estimated December imports could reach 8.6 million tons, bringing full-year imports to a record high of around 112 million metric tons.

China, which had largely shunned U.S. soybeans for months amid a tense Washington-Beijing trade standoff, has stepped up purchases recently following late-October talks between the two countries’ leaders in South Korea.

State-run grain buyer COFCO has led the buying, booking around 2.7 million tons of U.S. soybeans since late October, according to U.S. Department of Agriculture data.

The recent deals remain well below the White House’s year-end target of 12 million tons, but U.S. Treasury Secretary Scott Bessent last week appeared to push the deadline to the end of February.

China has yet to officially confirm the volume or schedule.

China’s Sinograin to auction 512,500 metric tons of imported soybeans on Dec 11

China’s state stockpiler Sinograin is set to auction 512,500 metric tons of imported soybeans on December 11, its first such sale in three months.

Sinograin previously sold 22,500 metric tons of soybeans on September 11.

China’s vice premier holds ‘constructive’ call with Bessent and Greer

Top Chinese and U.S. officials held a call on Friday to discuss trade, including ongoing efforts to implement an agreement to de-escalate their countries’ trade war.

Chinese Vice Premier He Lifeng had an “in-depth and constructive” video call with U.S. Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer, China’s official Xinhua news agency reported.

Both sides agreed to promote the stable development of bilateral trade and economic ties, and “expand the list for cooperation and shorten the list of problems”, according to Xinhua.

Parties to the call “positively evaluated” the implementation of the outcomes of earlier trade talks, and discussed the next steps in carrying out cooperation and addressing each other’s concerns.

Bessent, in a post on X, said the officials discussed the implementation of the “Busan arrangement,” which presidents Donald Trump and Xi Jinping approved in October during face-to-face talks in the South Korean city.

Under that agreement, the U.S. agreed to trim tariffs on China in exchange for Beijing cracking down on the illicit fentanyl trade, resuming U.S. soybean purchases and keeping rare earths exports flowing.

Bessent said in his post that the implementation of the arrangement was “going well.”

“I also reaffirmed the United States’ commitment to continued engagement with China,” Bessent said.

On Wednesday, Bessent said China was poised to complete its commitments under the U.S.-China deal, including the purchase of 12 million metric tons of soybeans, which the Treasury chief said would be finished by the end of February 2026.

Gapki Sees Little Impact of Indonesia Floods on Palm Oil Output

Deadly floods and landslides in Indonesia’s Sumatra island are unlikely to have any significant impact on the nation’s palm oil production for 2025, according to the Indonesian Palm Oil Association, also known as Gapki.

- The association has only received reports of one palm company halting production so far; the firm in Aceh Tamiang needs repairs on storage tanks, said Gapki Chairman Eddy Martono

- No disruptions so far at plantations but roads to Aceh’s port are under repair after flood damage

- Association members in two affected regions, West Sumatra and North Sumatra, have not yet reported disruptions, Martono said

- NOTE: More than 900 people have died in recent floods and landslides in Aceh, North Sumatra and West Sumatra provinces

- NOTE: Indonesia is the world’s largest producer of palm oil, which is widely used in food, cosmetics, and biofuel

Russian wheat may gain advantage on global market due to quality – experts

Russian wheat may gain an advantage on the global market due to higher quality despite increased grain supply from competitor countries in the Southern Hemisphere, experts from the Agroexport federal center said.

In recent months Argentina and Australia have reported improved prospects for the wheat harvest in the 2025-2026 season, Agroexport said. For example, in its December report, the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) raised its wheat production forecast to 35.6 million tonnes, which is 1.5 million tonnes more than was harvested the previous season.

Argentina’s Buenos Aires Grain Exchange (BAGE) increased its wheat harvest forecast to a record 25.5 million tonnes due to higher-than-expected yields in some regions. This is 6.9 million tonnes more than in the past season.

This situation is putting pressure on wheat quotations in the global market. At the same time, despite the record harvest, market participants note that a lot of wheat with low protein content is coming from Argentine fields – around 9%-10% compared to the Argentine export standard of 11.5%, the center said.

In connection with this, a noticeable difference in quality spreads between Argentine and Russian wheat is being recorded. In Argentina, the price difference is $15-$20 per tonne, and $3-$5 per tonne in Russia.

“The Southern Hemisphere harvest will in any case put pressure on the global wheat market. However, if the situation with the quality of Argentine grain remains unchanged, demand for Russian wheat may increase,” the experts said.

As reported, according to data from the Federal Center for Assessing the Safety and Quality of Agricultural Products (TsOK APK), the quality of the 2025 wheat harvest in Russia is higher than last year. This is shown by the results of state monitoring conducted in 67 regions of the country. The share of grade 3 wheat at the beginning of November was 30.5% compared to 29% a year earlier. The share of grade 4 wheat decreased to 47.3% from 48% and grade 5 to 22% from 23%, respectively. A small amount of grade 1 and grade 2 wheat was also identified. Overall, the share of food wheat (grades 1-4) is 78% compared to 77% in 2024.

Indonesia Aims to Seize 4m Ha of Illegally Used Land by Year-End

Govt expects to seize 4m hectares of land being illegally used for mining, palm oil and forestry, says Barita Simanjuntak, an expert staff at the Attorney General’s Office (AGO) at a briefing in Jakarta on Monday.

- Authorities have seized 3.77m ha as of Dec. 8 this year

- Fifty-one companies in six provinces own about 5,800 ha of seized mining concessions

- AGO has ordered 49 palm oil companies to pay a total of 9.4t rupiah in fines and 22 miners to pay 29.2t rupiah

- Of the combined total, 15 firms have paid 1.7t rupiah in fines, while the remainder either expressed a readiness to pay or filed complaints

- Govt to take firm action against companies that don’t pay their fines

CORN/CEPEA: Price Index is close to BRL 70 per bag

Corn prices have been moving up in the domestic market since mid-October. This week, specifically, increases have been related to the higher interest of purchasers along with the fact that sellers are away from closing trades. The ESALQ/BM&FBovespa Index for corn prices is close to BRL 70 per 60-kg bag, a level that had been verified for the last time in May 2025, in nominal terms.

The ESALQ/BM&FBovespa Index for corn prices upped 2% from November 27 to December 4, to close at BRL 69.97 per 60-kg bag on Dec. 4. On the average of the regions surveyed by Cepea, in the same comparison, corn values increased 0.9% in the wholesale market (deals between processors) and 0.5% in the over-the-counter market (paid to farmers).

Corn farmers are focused on sowing activities and on the development of the crops. In some regions, producers are concerned with the warm weather and in others with the impacts of the rainfall. As a result, they limit the volume offered in the spot market, waiting for new price rises.

Purchasers, in turn, aim to replenish inventories for the end of this year and for the beginning of 2026; however, sellers have been offering high values. Some purchasers are away from closing deals in the spot market, expecting price drops, based on the proximity of the summer crop harvesting (which may lead producers to open room in warehouses and/or make cash flow), on the high domestic surplus and on the fact that exports are moving at a slower-than-expected pace.

For the time being, although sellers are away from closing trades and despite the fact that the 2024/25 season had hit a record, the pace of deals continues similar to that verified last year. In Mato Grosso, for instance, data from Imea indicate that 81.11% of the production had been traded up to mid-November, below the 85.79% registered in 2023/24 and lower than the 86.99% verified in the average over the last five crops.

SOYBEAN/CEPEA: Price gap reduces liquidity

Trades of soybean and byproducts are moving at a slow pace in early December, limited by the gap between prices offered by purchasers and asked by sellers. While most consumers are supplied and expecting price drops, many soy farmers have cash flow and are unwilling to offer new batches in the spot market.

Soybean producers are focused on crop activities and concerned about possible productivity losses, especially in regions that have registered lack of rains. Players surveyed by Cepea say that is unlikely that the 2025/26 crop hits the 177 million tons projected by Conab. Soybean sowing activities totaled 86% of the area until Nov. 29, lower than the 90% verified in the same period of the crop before – data from Conab.

In the Central-West, players are focused on the irregular rainfall and on the low soil moist in important producing areas. Sowing activities are finished in Mato Grosso and are at 96% of the area in Mato Grosso do Sul. In Southern Brazil, activities reached 97% of the total in Paraná and are at 65% in both Rio Grande do Sul and Santa Catarina.

Egypt to Boost 2026 Wheat Cultivation Area to 3.5M Feddans

Egypt plans to boost the area used for growing wheat to 3.5m feddans in the 2026 season, Agriculture Minister Alaa Farouk says in an interview with Bloomberg.

Area available for wheat cultivation in the 2025 season that ended in August was 3.2m feddans

Export duties on Russian wheat, barley, corn will be zero as of Dec 10 -Agriculture Ministry

The export duties on Russian wheat, barley, and corn will be zero as of December 10, the Agriculture Ministry said.

The duty on wheat was 8.9 rubles per tonne in the previous duty period, while the duties on barley and corn will remain zero.

The duties are based on indicative prices of $226.10 per tonne for wheat against $227.30 per tonne the previous duty period, $213.60 per tonne for barley versus $210.80 per tonne, and $208.50 per tonne for corn against $211.80 per tonne.

The new rates are valid until December 16, inclusive.

Russia introduced a grain damper mechanism on June 2, 2021, which stipulates floating duties on the export of wheat, corn and barley and the return of funds received from them to subsidize agricultural producers. The duties are calculated weekly from indicators based on the prices of export contracts registered on the Moscow Exchange (MOEX: MOEX). Duty rates were initially calculated in dollars and in rubles since July 2022. The duty is 70% of the difference between the reference and indicative prices.

The base price is currently 18,000 rubles per tonne for wheat and 17,875 rubles per tonne for barley and corn.

US Poultry Slaughter Rose 0.7% Y/y in October: USDA

Slaughter rose to 6.53 billion pounds, according to the USDA’s monthly poultry slaughter report released on the agency’s website.

- Chicken live weight rose 1.1% in October from year ago

- Chickens condemned post-mortem down 7% y/y

- Condemned ante-mortem up 10.5% y/y

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2025 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

The Ghost in the Machine Q3 2025

October 6, 2025

ADM Exceeds 5M Regenerative Agriculture Acreage Gal

September 9, 2025