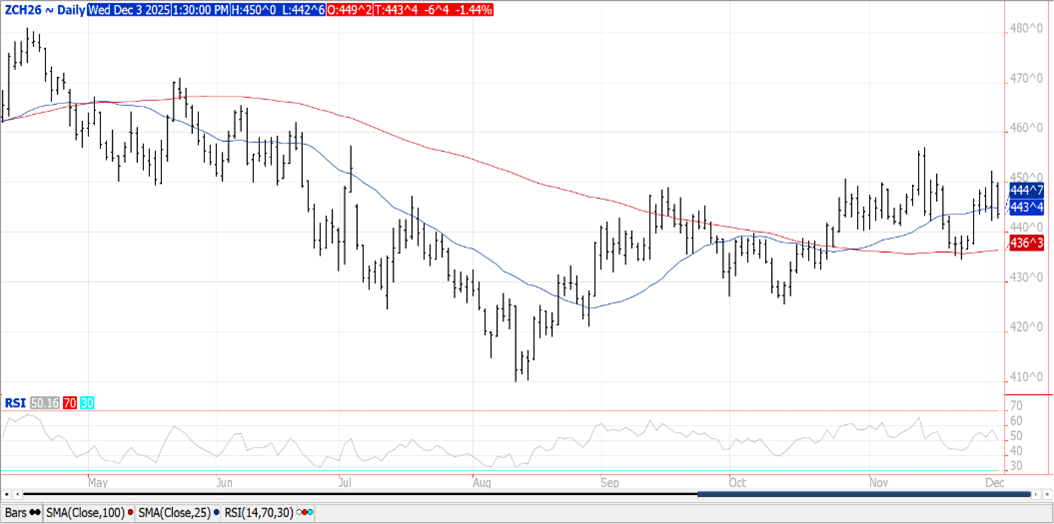

CORN

Prices were down $.06-$.07 giving back all of yesterday’s gains. Spreads were mixed and little changed. Mch-26 futures fell back below its 50 day MA however held within yesterday’s range. Next support is at the 100 day MA at $4.36 ¼. Deliveries against Dec-25 fell to only 4 contracts. Yesterday’s CFTC update as of Oct. 21st showed MM’s were net buyers of 30k contracts, reducing their net short position to 161k. Ethanol production jumped to 1,126 tbd, or 331 mil. gallons in the week ended Fri. Nov. 21st up from 327 mil. the previous week and up 5% from YA. Production was a new all-time high and well above the pace needed to reach the USDA usage forecast of 5.60 bil. bu. There was 112 mil. bu. of corn used in the production process, or 16.03 mil. bu. per day, above the 15.3 mbd needed to reach the USDA forecast. Stocks jumped to 22.5 mil. barrels above expectations however below YA at 23 mb.

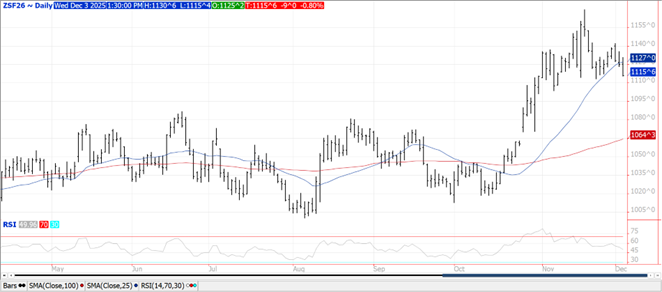

SOYBEANS

Prices were lower across the complex with beans down $.09-$.11 forging new lows into the close, meal was steady to $2 lower while oil is a full penny also closing near session lows. Bean and meal spreads firmed while oil spreads weakened. Jan-26 beans traded to a new low for the week with next support at $11.13 ¼. Jan-26 meal fell to a fresh 5 week low. Jan-26 bean oil slipped back below its 100 day MA. Soybeans traded moderately higher overnight after wire services late yesterday reported 6 vessels are scheduled to load out soybeans from the US gulf for shipment to China by the mid-December. A 7th vessel was loaded this past weekend and is enroute to China. Announced sales to China since late Oct-25 at 2.25 mmt, well below the 12 mmt the Trump Admin. claims China has agreed to buy in the 25/26 MY. US FOB offers for Jan-26 shipment are about $.40 bu. over those from Brazil. That premium stretches out to $.90 bu. by March as we get deeper into the Brazilian harvest. While the data seems to suggest otherwise, US Treasury Sec. Bessent today stated Chinese soybean purchases are on stride to reach it’s promised volume figures. Spot board crush margins slipped $.02 ½ to $1.37 ½ bu. while bean oil PV dropped back to 45.4%. There were 2 contracts put out for delivery against Dec-25 meal with 128 against Dec-25 oil. CFTC data as of Oct. 21st showed MM’s were net buyers of nearly 36k soybeans, just over 27k meal while sellers of nearly 1k bean oil.

WHEAT

Prices were $.03 – $.05 lower with all 3 classes experiencing 2 sided trade. Mch-26 contracts across all 3 classes also held within yesterday’s range. CFTC data showed MM’s in the week ended Oct. 21st were net buyers of nearly 3k CGO contracts, just over 400 KC, while selling nearly 600 MIAX. SovEcon reports Russian wheat export prices have fallen roughly $4 since mid-November, down to $228-$230/mt. Larger than expected production in Argentina where prices are offered at $208/mt, have pressured Russian offers. Wire services are reporting Algeria has started purchasing wheat for their nominal 50k mt tender paying around $256/mt CF. Negotiations are reportedly ongoing with volume figures currently unclear. Stats Canada will release updated production forecasts tomorrow at 7:30 AM. Trade expects they raise their forecast 2 mmt 38.5 mmt, just above USDA Nov-25 forecast at 37 mmt.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2025 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

The Ghost in the Machine Q3 2025

October 6, 2025

ADM Exceeds 5M Regenerative Agriculture Acreage Gal

September 9, 2025